Menu

COVID19 tax measures in the GCC

Read our overview of the tax measures taken in the GCC in relation to COVID19. Our overview may be subject to daily updates.

Read our overview of the tax measures taken in the GCC in relation to COVID19. Our overview may be subject to daily updates.

Over supply of oil and under demand due the current economic crisis caused by COVID-19 has led to WTI prices for oil fall below zero as at 21 April 2020. Storage capacity is near full and therefore expensive. In the present situation, sellers are paying buyers to take oil off of their hands.

The situation is complicated for the oil sector and adds another “unprecedented” badge to the state in which the world currently finds itself in dominated by a health and economic crisis. Like oil companies, tax authorities now also face the task of having to consider how their legal frameworks apply to negative oil prices. We analyse those issues below.

Buyers are doing sellers a service for VAT purposes

At first sight Value Added Tax rules are made for transactions happening with a positive value. They calculate VAT on the price agreed with the customer. Whether the VAT laws implicitly assume that the transactions are always at a positive value is probably debatable, but certainly not unreasonable.

The tax authorities are expecting VAT revenue on the sales, not having to refund VAT to the sellers. Although the VAT law allows you to sell at a loss, to make no sales but have the intention of selling and still recover input VAT, hand out goods for free (taxed as deemed supplies), it does not foresee the situation of negative values charged when a good is sold.

The current situation is very similar to a furniture store charging a pick up fee for picking up your old furniture. The furniture store receives the ownership of the old furniture for free and charge a service fee for the pick-up. It then goes on to perhaps on-sell the old furniture, up-cycle it or use it for its own purposes.

Irrespective of the technical debate, tax authorities will be lukewarm to the idea to allow sellers to issue invoices with negative values. This would effectively mean that for each sale made, the tax authority would have to refund VAT to the seller. The only negative values allowed to be mentioned by sellers are usually reserved for credit notes. It therefore stands to be reasonably expected that tax authorities will take the view that buyers are rendering a service to the sellers. Therefore the buyers will need to issue an invoice to the sellers.

Depending on the applicable place of supply rules, that service will then effectively be subject to VAT, or not. Given that most of the sellers and buyers will be businesses with full input VAT recovery, that should not constitute an issue.

With the place of supply rules in the individual GCC countries, which deviate from the GCC VAT Framework, and their mix up with the zero rating rules (oddly imported from New Zealand), this may trigger some additional concerns for foreign sellers, which may be charged with 5% GCC VAT when the service relates to a good in the GCC. Even though a business refund is foreseen, it is only currently effectively available in the UAE, and only on condition of reciprocity.

In the UAE, VAT registered buyers of crude or refined oil are expected to apply the reverse charge mechanism on the domestic purchase of these goods. Instead of reverse charging on purchases for negative amounts, they will now likely need to apply VAT on a service. In a domestic context, this means an additional 5% VAT added for the seller, which, recoverable as it may be, will lead to added pre-financing for the seller. In KSA, local traders were already used to applying 5% VAT to each other. In Bahrain, a zero rate applies for oil and oil derivates.

It is safe to say that this is uncharted territory and that diverging opinions on the topic may emerge.

Non deductible expenses and additional withholding taxes

The situation from a corporate tax point of view seems, again prima facie, slightly more straightforward. The corporate tax is generally calculated on the basis of the books of account of the seller. From a financial point of view, and from a conceptual point of view, those books could record negative revenue (Note: the author of this article is not an accounting expert).

Negative revenue goes untaxed, because the business is not making positive sales. However, does the negative revenue constitute a deductible expense which reduces your corporate tax liability? This issue will surely be hotly debated with the tax authorities in the GCC which will be required to take a stance.

Additionally, in countries with broad withholding tax provisions on services, like KSA, there may be an additional element of surprise. The main concern with the fact that buyers may now be providing services to the sellers, is that when such a service takes place in an international context, the Saudi payer may need to apply a withholding tax (subject to relief in double tax treaties).

Click here for Aurifer’s quick cash flow tips to increase your liquidity during these uncertain times.

Offsets are types of arrangements in which the governments procuring from overseas may oblige the suppliers to reinvest some proportion of the contract in their country. This allows the governments of the purchasing country to regain some of the economic benefits that it may be losing as a result of substantial public sector expenditures on foreign products, services and technology.

The offset programmes also stimulate multinational corporations to seek business opportunities with the local private sectors in a number of fields. There are direct and indirect offset agreements. Direct offset agreements are related to the good or service imported, and could require co-production or subcontracting. Indirect agreements may involve purchases of goods or services unrelated to the main contract. Offset programmes in the GCC The GCC-countries typically import defense equipment and ancillary services from abroad. In order to compensate trade imbalances and within the context of overall economic strategy, offset programmes in the GCC typically require the defence contractors to make investments in the importing country. In the GCC, the Kingdom of Saudi Arabia (“KSA”), United Arab Emirates (“UAE”), Kuwait, and Oman have implemented offset programs. Qatar and Bahrain have not officially announced any programme and may conclude contracts on a case to case basis. Taxation issues With regard to taxation in the GCC, there are some GCC wide taxation rules relating to VAT and Customs and some country specific tax rules. Currently, VAT has been introduced in only three GCC States, the UAE, Bahrain, and the KSA in a fairly similar manner, whereas corporate income tax is implemented in four GCC (States, Kuwait, Qatar, Oman and the KSA). We cover the tax aspects of defence offset programs in the GCC in more detail below. GCC VAT The main supply contract normally involves the export of goods to the GCC territory by a foreign business. To determine the VAT implications from the seller’s perspective, it is important to analyse the contractual obligations between the seller and the customer. Generally, the obligation of the seller is limited to the export as the buyer imports the goods into the GCC and pays the import VAT (if any). The seller will not have any VAT obligations in the importing country. In case the supplier is required to import into the GCC, import VAT will be due. The subsequent supply to the buyer then becomes a domestic supply. The common VAT rate across the GCC is 5%. However, generally, the goods are imported into the GCC by or on behalf of armed forces or internal security forces and they qualify for a VAT exemption. The offsets, on the other hand, can be provided in multiple forms such as training, technology transfer, investments, maintenance of vehicles etc. Therefore, the VAT implications may vary depending on the type of services which are being offered as part of the offset contract. Generally, for the services supplied by a foreign seller who does not have a Fixed Establishment (“FE”) in the GCC, the customer has to account for VAT, provided the customer is registered for VAT in the respective GCC Member State. However, these contracts are mainly entered into by the government entities which may not be registered for VAT in the GCC. This would entail that the seller will have to get registered for VAT purposes in the GCC and to charge GCC VAT. It also very common that the sellers have human and technical resources in a fixed location to render or receive services in the country where it has offset obligations. This would mean that the foreign seller effectively has a FE and an obligation for VAT registration. Customs duties All of the GCC Member States apply custom duties upon the entry of goods into the their respective country. The importer of record is responsible for the payment of custom duties at the point of entry. In general, a 5% custom duty applies in the GCC. However, an exemption from custom duties is available for imports of military goods by or on behalf of all sectors of the military forces and internal security forces. An import permit along with a letter from the armed forces or the internal security forces may be required confirming the ownership of the goods if someone else is importing on their behalf. Corporate Income Tax Kuwait, Qatar, Oman and KSA apply corporate income tax on the adjusted net profits derived from income in the respective Member State at the rate of 15%, 10%, 15%, and 20% respectively (often with exemptions for GCC held companies). Companies carrying out business in these States, either by setting up a local entity or by virtue of having a Permanent Establishment (“PE”), are subject to corporate income tax. A PE by definition is as a fixed place of business through which the business of a taxpayer is wholly or partly carried on. This may include, for example, a branch, office, factory, workshop, a building site, or an assembly project (a “fixed PE”). A PE also includes activities carried out by the taxpayer through a person acting on behalf of the taxpayer or in the taxpayer’s interest, other than an agent of an independent status (the so-called “agency PE”). Some GCC Member States have a wide interpretation of the concept of PE in order to tax all income sourced from the States, such as a “services PE”. The export under the supply contract, would arguably not have its source in the GCC and the export of goods, standalone, would not trigger the qualification as a PE in the tax jurisdiction where the goods are shipped to. The offset arrangements potentially increase the risk of having a PE. Services offered as offsets, if performed for a prolonged period of time along with the deployment of employees, can give rise to a service PE for the foreign businesses. Withholding taxes or retention The GCC States which implement corporate income taxation, generally, also apply domestic withholding taxes on the payments made from the State to a business outside the State. Qatar applies a withholding tax of 5%, Oman applies 10% (with some recent exceptions), and the KSA applies between 5%-20%. The income tax law in Kuwait does not impose any withholding tax and rather applies a retention tax of 5% on each payment made to any suppliers until it is confirmed that the respective supplier has settled all of its tax liabilities in Kuwait. Qatar also has a local retention. The withholding taxes are applicable only on the gross income generated from a source located in the respective State, such as royalties, dividends, interest, consideration for research and development, management fees etc. However, this mostly excludes the payments made for the purchase of goods from a foreign seller. Therefore, no withholding taxes would apply to the export. Any double tax treaties signed by the concerned GCC Member States may provide a relief for the withholding taxes. The withholding taxes may not apply, if a company has a PE in the concerned Member States, and payments are attributed to the PE. Key takeaways For supply contracts, where GCC governments import goods supplied by foreign suppliers into the GCC, no direct taxes apply on the imports into the GCC and the taxation issues mainly relate to indirect taxes, such as VAT and customs duties. The tax regime applicable to offsets is more complicated than the tax regime applicable to the supply contract. Offsets can create a PE for corporate tax and a FE for VAT. This means that the foreign seller will have to get registered for VAT and also for direct tax purposes and attribute profits to the PE. Managing the supply chain well can avoid any additional VAT or customs duty costs. Other unavoidable taxes should be taken into account by sellers when finalizing contracts with GCC governments.

In recent years the Middle East has been investing heavily in Research and Development (R&D). This has resulted in a number of patents being requested and made room for a number of so-called unicorns, like Careem and Jumia.

Although, according to UNESCO statistics, the Arab States and the Middle East are still behind the Western world in terms of R&D spending per capita, the investments in R&D are substantially increasing.

This article covers the taxation of Intellectual Property (IP) in the Gulf and discusses how international tax developments have had an important impact on the taxation of IP.

How IP is taxed domestically in the Gulf

The Gulf has a few interesting jurisdictions to hold IP. Two Gulf countries, the UAE and Bahrain, do not levy corporate tax and are therefore attractive tax jurisdictions. The other countries have a less or more developed corporate tax system, often coupled with exemptions if businesses are held by GCC nationals.

None of the GCC states have developed specific IP regimes to attract investment in the same way as many industrialized nations have. They may have specific depreciation rates (e.g. Oman allows depreciation rates of 33% per annum).

The absence of specific IP regimes may not necessarily be a handicap, because of the exemption for businesses held by GCC nationals (which are then sometimes subject to Zakat, depending on the country), coupled with relatively low corporate tax rates (only up to 20% in the case of KSA, the highest rate).

Free Zones in the UAE are zones who can guarantee on the basis of their establishment laws that no corporate income tax is levied on businesses established in the Free Zone (although mainland businesses mostly also do not pay corporate income tax). Some of these Free Zones specifically focus on offering licenses for companies who want to locate their IP in that zone.

VAT, introduced in the UAE and KSA on 1 January 2018 and in Bahrain on 1 January 2019, is only charged at a low rate of 5%. Between licensor and licensee, VAT usually does not constitute any issue, because licensees are generally in a position to fully recover any input VAT.

Given the absence of personal income tax in the GCC states, business owners selling their shares in a business holding IP, will be able to realize a capital gain which will go untaxed.

Because of the above described context, the Middle East can be an interesting tax jurisdiction to license IP to other jurisdictions as a holding jurisdiction.

Due to the ease of relocating IP many businesses did so

There are a multitude of types of planning structures which were being used by businesses wanting to locate their IP in more tax friendly countries.

Some are more straightforward. Belgium has its Deduction for innovation income, France has its reduced CIT rate for IP income, Luxembourg had its now abolished partial exemption for income derived from certain IP rights, to name just a few. Switzerland and the UK had their license box and patent box respectively.

Other tax planning structures required more tax trickery and used amongst others gaps in the international tax framework.

Large scale tax planning happened amongst others with American tech companies, who looked at moving their IP to certain European States for tax planning purposes. In the same way, companies can and have been tempted to move their IP to certain jurisdictions in the Middle East.

Moving IP can be taxing

Due to the high mobility of IP, the Western world had been increasingly eyeing tax planning structures with IP, amongst others to avoid that businesses develop IP in the Western world, claim tax credits to then move the developed IP out of the high tax jurisdiction into a low tax jurisdiction or harmful tax jurisdiction.

According to the OECD, the misallocation of the profits generated by valuable intangibles has contributed to base erosion and profit shifting.

In recent years, under the OECD sponsored BEPS project, the Western world has developed a number of tools to fight this practice (e.g. a nexus approach towards claiming tax credits). More specifically for the Middle East, some States have had to introduce economic substance rules and others adopted transfer pricing rules.

For intangibles, the OECD guidance clarifies amongst others that legal ownership alone does not necessarily generate a right to all (or indeed any) of the return that is generated by the exploitation of the intangible. Group companies performing important functions, controlling economically significant risks and contributing assets, are entitled to an appropriate return reflecting the value of their contributions.

In other words, the OECD guidance specifically targets situations where multinationals relocate their IP into a different legal entity which may not have contributed to the IP.

What BEPS means for IP in the Middle East

The BEPS programme, started in 2013, was developed by 44 countries, including all OECD and G20 Members. It has three main objectives:

– Reinstating the coherence of corporate income taxation from an international perspective

– Putting the substance of the economic activities at the core of international taxation, and

– Ensuring transparency in the global economy.

It resulted in the publication of 15 action plans in October 2015, known as the BEPS package.

Out of the 15 action plans, in January 2016 the OECD prioritized 4 key priority measures. These measures are known as the BEPS Minimum Standards. They constitute the BEPS Inclusive Framework. The four Minimum Standards which had to be implemented are:

· Fighting harmful tax practices (BEPS Action 5),

· Preventing tax treaty abuse, including treaty shopping (BEPS Action 6),

· Improving transparency with Country-by-Country Reporting (BEPS Action 13),

· Enhancing the effectiveness of dispute resolution (BEPS Action 14).

The Inclusive Framework Members have committed to implement these actions quickly. All of the six GCC States, except for Kuwait, are a member of the Inclusive Framework. Even if Kuwait is not a member, it is nonetheless expected to implement certain elements of the BEPS Action Plan. Around 137 countries are currently a member of the Inclusive Framework.

The BEPS project explains the recent legislative developments in most GCC States. KSA introduced extensive transfer pricing legislation and published extensive guidance. Qatar, KSA and UAE have also introduced Country by Country reporting.

We can expect further developments with respect to Country by Country reporting in Bahrain and Oman, and ultimately Kuwait as well.

Other relevant BEPS Actions are Actions 8 to 10, which relate to transfer pricing. More specifically BEPS Action 8 relates to intangibles, of which IP is an element. It is BEPS Action 8 which developed the DEMPE criterion covered below.

In the same BEPS context, UAE and Bahrain implemented Economic Substance Regulations.

Economic Substance in UAE and Bahrain

Bahrain and the UAE, on the account of being NOON tax jurisdictions (NO or Only Nominal tax), and at the risk of being considered harmful tax regimes, have introduced Economic Substance Regulations. Bahrain did so in early 2019, the UAE a bit later in the same year. The introduction of Economic Substance Regulations was a consequence of the implementation of BEPS Action 5.

It was important that both Bahrain and the UAE implemented these Regulations, since being on the so-called OECD blacklist can have important consequences for foreign trade with the UAE and Bahrain. The UAE and Bahrain are now no longer blacklisted by the OECD.

Economic Substance Regulations focus on a number of highly mobile activities or regulated activities and require businesses to maintain a certain degree of substance. In absence of having such substance, the business can be fined. In addition, the local competent authority (often the Ministry of Finance) may exchange information on the local business with a foreign tax authority. It will therefore flag a risk, which may lead to a tax audit.

One of the activities which Economic Substance Regulations looks at is Intellectual Property. In the UAE, there is even a rebuttable presumption that a business which licenses Intellectual Property does not meet the Economic Substance Test. It is up to the business to meet the DEMPE criterion. We explain further in this article what that DEMPE criterion is.

Transfer pricing in the Gulf

Transfer pricing is a relatively recent concept in the Gulf. Although many countries had a similar provision in their tax legislation requiring that transactions be at arm’s length, some Gulf countries recently introduced more extensive transfer pricing legislation. We explained above that this is a consequence of the OECD BEPS project.

BEPS Action 8 looks at the taxation of intangibles and suggests the use of the below explained DEMPE criterion. KSA, which has the most advanced transfer pricing legislation, has endorsed the OECD’s TP guidelines and therefore also the DEMPE criterion.

BEPS Action 13 requires businesses to file a country by country report. Qatar, KSA and the UAE have all introduced Country by Country reporting based on the OECD models. Country by Country reporting is only a requirement for multinational businesses with a consolidated turnover in excess of 750 million EUR (or the equivalent in local currency). Table 2 of the Country by Country report requires taxpayers to flag whether the entity in the respective tax jurisdiction is involved in holding or managing intellectual property. This requirement is specifically with the objective of zooming in on the use of intellectual property.

What is DEMPE

In the recently implemented Economic Substance Regulations and transfer pricing legislation, the so-called DEMPE criterion is used. DEMPE stands for Development, Enhancement, Maintenance, Protection and Exploitation.

DEMPE helps both taxpayers and tax authorities achieve an accurate assessment of transactions to help with the determination of appropriate transfer pricing. By identifying the entities that perform DEMPE functions in a transaction, taxpayers can ensure that they are complying with the OECD’s BEPS guidelines.

The DEMPE functions can be performed by several entities of the group. However, if the mere function of a legal entity is holding the IP, under the DEMPE criterion, it will not be able to claim any profit whatsoever in the tax jurisdiction where the IP is held.

Any income generated as a result of that IP is owned by all the parties that perform the DEMPE functions. So, rather than the IP owner receiving the full amount of the returns generated by the intangible, these instead have to be divided between the relevant parties, in line with each entity’s contribution to the value of the IP.

In other words, if a UAE or Bahraini company solely hold the IP, it will not be entitled to any profit. In addition, if royalties are charged to group licensees abroad, these charges may potentially be considered as not being at arm’s length and therefore nondeductible for the payer.

The Gulf is right in investing more in IP

Government and private backed investment in R&D are increasing in the Gulf. Homegrown IP will more easily satisfy the DEMPE criterion.

With the increased importance of the DEMPE criterion and sources of information for foreign tax authorities with respect to IP, tax planning with IP may prove more challenging. A mere location of IP into a Gulf country will not be viewed favorably by foreign tax authorities.

Some of the Free Zones may want to consider increasing the requirements for businesses wishing to hold their IP in the Free Zone since a company purely holding the IP and licensing it will not satisfy the DEMPE criterion. On the other hand, the DEMPE criterion offers a real chance for the Gulf to build on its recent experiences as an R&D hub.

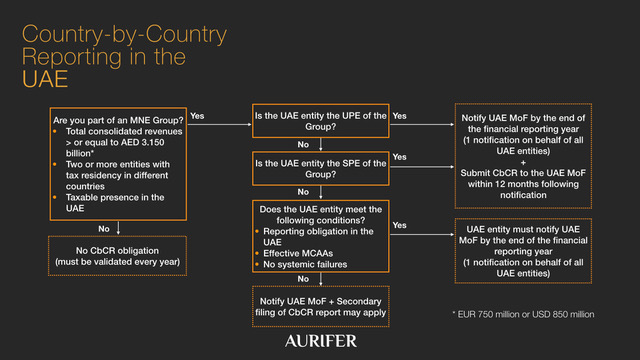

By way of a Cabinet Resolution, the UAE has introduced Country by Country reporting (“CbC reporting”). Almost simultaneously with the introduction of economic substance regulations, the UAE further implements international tax standards and joins around 80 other countries which have implemented the CbC reporting. The impact of this reporting on international corporations in the UAE cannot be understated.

Background

In the Framework of the Base Erosion and Profit Shifting (“BEPS”) project of the OECD and the G20, countries agreed, amongst others, to implement BEPS action 13 in order to tackle the shortcomings of the international tax system.

This action prescribes that countries implement legislation requiring multinational enterprises (MNEs) to report annually and for each tax jurisdiction in which they do business certain relevant tax related information and exchange this information with other countries.

UAE implementation

The UAE’s legislation very much mirrors the standards imposed by the OECD which have been adopted in countries which have already implemented CbC reporting. It is applicable to groups which have subsidiaries in at least two tax jurisdictions. The threshold for the consolidated revenues is AED 3.15 billion.

Ultimate Parent Entities in the UAE will therefore have the obligation to file a CbC report to the Ministry of Finance (“MoF”). Certain entities in the UAE may become Surrogate Parent Entities as a result of the legislation.

The Federal Tax Authority is not involved in the process, even though according to its Establishment Law it is also competent.

There is currently no requirement to prepare master files and local files. There is additionally no requirement to file a Controlled Transactions Disclosure Form or similar, which KSA has implemented.

Information to be shared by 31 December 2019

The CbC report needs to include the amount of revenues, profits (losses) before income tax, income tax paid, income tax payable, declared capital, accrued profits, number of employees, and non-cash or cash-equivalent assets for each country. In absence of any UAE Generally Accepted Accounting Principles, it will be interesting to see what accounting methods will be used to share the information.

In addition to the above information, the tax residency of the subsidiaries needs to be disclosed, the nature of its activity or main business activities.

The notification needs to be done by the end of this year and the CbC report by the end of 2020 for companies with a financial year matching Gregorian calendar years. The portal can be found here: https://www.mof.gov.ae/en/StrategicPartnerships/Pages/Country-by-Country-Reporting.aspx.

In KSA, the CbCR notification is made along with the corporate income tax or zakat declaration (within 120 days following the financial year end). In case of the CbCR filing, similar principles apply where the report must be submitted within 12 months following the end of the reporting year of the MNE group. Recently, the General Authority of Zakat and Tax of KSA has made the portal available to submit such reports: https://gazt.gov.sa/en/eServices/Pages/eServices_082.aspx.

In Qatar however, since the CbCR portal is not in place yet, only Qatari resident Ultimate Parent Entities of the MNE Group who fall within the scope of the CbCR regulations are required to submit a notification for the financial year started 1 January 2018 and also another notification with respect to financial year starting on 1 January 2019 maximum by 31 December 2019.

The notification for two consecutive years will have to be done manually in paper form, until the online platform is set up. The notification has to be submitted to the Department of Tax Treaties and International Cooperation of the General Tax Authority of Qatar or the tax department of the Qatar Financial Center, whichever is applicable.

Sharing of the information

The collected information will be shared by the UAE Ministry of Finance with other countries with which it has information sharing agreements. These could be bilateral treaties or the Convention on Mutual Assistance in Tax Matters. The bilateral treaties concluded by the UAE generally include a provision allowing the exchange of information.

Internationally the intention is to move towards an automatic exchange of the CbC reports. The first automatic exchanges have taken place in June 2018.

Penalties for non compliance

If businesses fail to file to comply with their obligations under the CbC reporting, they run a penalty exposure of up to AED 2,250,000.

Conclusion

The UAE is the third GCC country to implement CbCr reporting after Qatar and KSA had done so previously. The context of the UAE is slightly different, given the current absence of Federal Corporate Income Tax. Both Qatar and KSA have a form of corporate income tax.

How useful the CbC reporting is for MoF currently in absence of any Federal Corporate Tax remains to be seen. However, the introduction of the reporting will allow the UAE to be removed from domestic, European and other blacklists.

The Federal Tax Authority may be interested in the file for VAT purposes and ask tax payers to reconcile the amounts in the CbC report, as it can do today already with audited financial statements.

The importance of the introduction of CbC reporting cannot be understated. The UAE’s important neighbour, Saudi Arabia, will be very keen to examine the information in the CbC reports filed by UAE companies to verify whether it is receiving the right end of the tax portion.

The UAE and the wider GCC in recent times have seen a few blockbuster bankruptcies with the downfall of Abraaj and Drake & Scull undergoing substantial restructuring to name just a few. As debt management becomes a greater area of focus, so do the tax consequences of debt management. The writing off of receivables, the transfer of receivables and insolvency, bankruptcy and liquidation all have important consequences from a tax point of view.

With four out of the 6 GCC countries applying corporate income tax, the direct tax consequences of debt management were already familiar to businesses. With 3 out of the 6 GCC countries implementing VAT, analyzing the tax consequences of debt management, now also needs to include a VAT analysis. This article summarises some of the most important issues for debt management.

Tax due to the tax authority

Tax payers who file their tax returns but do not pay their tax to the tax authority are faced with stiff fines. The obvious objective is to discourage non-compliance. The UAE is notorious for imposing the highest late payment penalties for tax purposes, which can go up to 300% of the tax due in the case of the UAE (Cabinet Resolution No. 40 of 2017 on Administrative Penalties for Violations of Tax Laws in the UAE – Table 1). The penalties in Bahrain and KSA are also steep and are very similar. The penalties depend on the type of tax liability, with for example KSA not harmonizing penalties for corporate tax and VAT.

With such high penalties imposed, they sometimes result in financial hardship. In KSA, a tax payer who finds himself in financial hardship can request an installment plan (article 71, 1 KSA Income Tax Law), but will still be subject to 1% late payment penalties per month (article 77, 1 KSA Income Tax Law). The late payment penalties for VAT purposes are higher in KSA (5% for each month).

However steep the fines may be, if the tax authority is not a secured or preferred creditor, it stands a much lower chance of its claim being settled. For example, the UAE Federal Bankruptcy law nor any of the UAE tax laws list tax claims as preferred claims (only amounts due to government agencies constitute privileged debts – article 189, 1, d UAE Bankruptcy Law). The UAE’s FTA can withhold a credit though when there is still a debt (article 35, 2 FTP Law). The Kuwait Income Tax Law on the contrary foresees that taxes and penalties constitute preferred debt over all other debts, except for salaries, wages and court expenses (article 40 Kuwait Income Tax Law).

When the tax authority is not a preferred creditor, the tax authority must undergo an imposed haircut of the debts a tax payer might have towards its creditors. In KSA, the tax authority can waive tax debts and penalties when their collection is considered impossible (article 79, 4 KSA Income Tax Law).

In most Western jurisdictions, the tax authority is a preferred and high ranking creditor. Interestingly, the UK only recently added its tax authority, HMRC, as a secondary preferential creditor.

Although both KSA and UAE have largely exceeded their objectives in terms of the income generated by VAT, in the longer run, since VAT generates a lot of revenue, they may lose out on some revenue do to insolvencies and bankruptcies.

Tax due on receivables

Potentially, a business comes into dangerous financial waters due to its customers not paying or not paying on time. Some sectors in the GCC, such as the construction sector, are notorious for paying late. Sometimes this may lead to liquidity crises and eventually the bankruptcy of a business.

When the tax payer has paid VAT already to the tax authority, it may benefit from so-called bad debt relief and receive a refund of the output VAT it paid.

Generally, a VAT refund is available where the supplier has accounted for output VAT before receiving payment from his customer and the debt becomes bad or doubtful (hence “bad-debt relief”). Bad debt is the debt that is unlikely to be paid, for example, because of the probable or actual financial failure of the debtor. Bad debts are also generally deductible for direct tax purposes.

The general rules for bad debt relief also apply where the customer becomes bankrupt. Under the bad debts adjustment scheme, creditors will be allowed to reduce the output liability in the VAT return. However, for creditors to claim relief under bad debts scheme, there are a set of conditions, which the creditors have to meet. These conditions are usually similar (and do not apply when accounting for VAT is done on a cash basis):

– Goods or services have been supplied and VAT has been charged and paid

– The creditor has (partially) written off the receivable

– A certain amount of time has passed since charging VAT (e.g. More than six (6) months have passed from the date of the supply according to Article 64 of the UAE VAT law).

Sometimes, it is required that the creditor has informed the debtor that the receivable has been written off. This counterintuitive logic may potentially worsen the issue, since the debtor will not feel particularly motivated to settle the debt after all.

In KSA, for the bad debt relief to apply to amounts in excess of 100,000 SAR, formal legal proceedings need to have been made to collect the tax (article 40, 7 KSA VAT Implementing Regulations).

The refund claim is made in the VAT return and no separate invoice is needed to claim the bad debts from the tax authority.

If as a result of the bankruptcy proceedings, or the improved insolvency of the tax payer, the debt is eventually paid by the debtor, then the creditors will be required to repay to the tax authority the VAT that had been refunded by the tax authority. If partial payment is received then only a proportion of the debt may be claimed.

The bad debts scheme helps the tax payer on the output side, however if the tax payer does not pay his vendors, he may suffer additional adverse financial consequences described as below.

From a direct tax point of view, the mere write off is sufficient to deduct the doubtful receivable from the taxable income of the tax payer (see e.g. article 14, 1 of the KSA Income Tax Law or article 55, 5 of the Omani Income Tax Law).

Tax deductible on payables

Generally, VAT charged to a tax payer can be deducted from the output VAT the tax payer has charged. Usually such a deduction is not linked to the actual payment to the supplier. It is foreseen in the EU VAT directive, the basis for the VAT system in the GCC, only as an option (article 167a Council Directive 2006/112/EC).

Bahrain and KSA followed the EU model. However, if a tax payer does not settle his debts, he needs to correct his input VAT deduction (article 46, A, 3 of the Bahraini VAT law and article 40, 10 of the KSA VAT Implementing Regulations).

In the UAE however, payment of the VAT is an explicit material condition for the input VAT deduction by a tax payer. In the UAE, a tax payer needs to pay or intends to make the payment of consideration for the supply within 6 months after the agreed date of payment for the supply (article 64 UAE VAT law).

The suppliers are required to pay the VAT to the tax authority even if they have not received the consideration from the debtor due to insolvency. This is because the time of supply rules do not take into account payment, unless for advance payments. Only KSA has cash accounting rules for VAT (article 46 KSA VAT Implementing Regulations).

If the customer, the debtor, has already recovered the input VAT on the basis of the tax invoice but eventually fails to pay, he needs to repay the deducted input VAT.

From a direct tax point of view, a natural person or legal entity in KSA is allowed to use a cash basis method instead of the accrual method for this accounting (article 23, 3 KSA Income Tax Law). In Oman and Qatar, the authority can allow a different method of accounting than accrual (article 12 Oman Income Tax Law and article 6 Qatar Income Tax Law).

Haircuts and transfers

So-called “haircuts” can be voluntary or imposed by a tribunal. They constitute a proportional reduction of the debts of a company in order for the company to try to continue its business unburdened by its debts.

Such haircuts can impact taxes due and payables. If the tax authority is not a preferred or privileged creditor, it will simply undergo the haircut and therefore need to make write offs.

Transfers of receivables constitute a good way of improving the liquidity of a business. Whenever a business transfers a receivable worth 100 $ face value in his books for a value of 90 $, he accepts a write off for 10 $. From a direct tax point of view, such a write off will reduce the tax liability.

When the transferred receivable also has a VAT component, matters become more complicated. A logical consequence of the write-off would be that the transferor can recover the output VAT paid on the balance. In the example above that means recovering output VAT on 10$. This VAT regime, like in other jurisdictions, is not always clear and is subject to interpretation and many rulings.

Although clearly no supply is made by the transferor, i.e. he is not supplying the transferee with a service but merely transferring a receivable in his books, tax authorities will sometimes consider this a supply. The UAE for example considers the transfer of a loan portfolio as an exempt supply (p. 28 FTA’s Financial Services VAT guide). This has the necessary consequences from the viewpoint of the input VAT deduction.

Bahrain follows the same treatment for the sale of debt (p. 49 NBR’s VAT Financial Services Guide), as does KSA (p. 18 GAZT’s Financial Services Sector Industry Guideline).

With respect to factoring however, for factoring with recourse, Bahrain and KSA adopt the position that assigning the receivable is an out of scope transaction. The UAE has not made its position explicit.

None of the GCC countries so far have taken a stance on a transfer of the right to claim the reimbursement of VAT on transferred bad debts, although this is an important financing component which can impact margins in an important way.

Administration of insolvency, bankruptcy and liquidation

When a company is struggling financially, it may become insolvent and seek protection from its creditors. It may end up in administration, and potentially in bankruptcy and liquidation. Such procedures can be taken at the initiative of the businesses, its creditors or a third party (e.g. the public prosecutor).

The aspects of insolvency, bankruptcy and liquidation as such are generally not regulated in the tax laws. Instead, as a separate set of legislation, they will impact the tax legislation.

The impact of these sets of legislation on the compliance of a business as such as limited. A business becoming insolvent or going bankrupt does not have a different status vis-à-vis the tax authorities. It continues as a regular tax payer. The same to a certain extent holds when a business goes into liquidation, with the difference that it is the intention to close the business and therefore also reduce the taxable supplies of the business. This means that the business eventually needs to deregister for VAT purposes and potentially make a self-supply. From a direct tax point of view, once the business ceases to exist, it has no tax obligations anymore, apart from a final tax return.

What is required though is that the tax payer communicates to the tax authority that it can no longer be legally represented by its usual legal representative, but instead now has an administrator, a bankruptcy trustee or other managing its tax obligations.

In the UAE, a legal representative needs to give a formal notice to the FTA within twenty business days from the date of appointment along with the evidence of the legal basis of his appointment. Penalties are imposed on the legal representative in the event of failure to inform the FTA in the given timeframe or failure to file the tax return in the specified timeframe. Penalties would be due from the legal representative’s own funds in the event of default. KSA foresees similar provisions, however less strict (article 77, 5 KSA VAT Implementing Regulations). In Oman such a person becomes the principal officer of the organization (article 6, 2, e Omani Income Tax Law).

The Blockbuster Bankruptcy will hit you – so you might as well be prepared

With some uncertainty governing the tax framework of doubtful receivables and bad debt, the different tax authorities will have an important role to play in defining it for financing transactions or in the framework of insolvency proceedings.

Forgetting about the VAT refund procedures or the possibilities for write-offs to impact your direct tax liabilities may prove costful. Suppliers claiming bad debt relief may actually worsen the situation of the debtor.

Given the international economic climate, it is a matter of time before businesses in the GCC are confronted with another blockbuster bankruptcy. Governments and private creditors alike should prepare for the scenario, not just to anticipate a loss and its tax consequences, but also to monitor their liquidity.

Earlier this year, the United Arab Emirates (“UAE”) issued Cabinet Decision No. 31 concerning economic substance requirements (“Economic Substance Regulations” or “ESR”). UAE onshore and free zone entities (“Licensees”) that carry out one or more Relevant Activities as defined under the ESR, are required to meet the Economic Substance Test in respect of the Relevant Activities carried out in the UAE. However, many businesses were left wondering how to meet certain criteria set out by the ESR. We previously wrote on the issue. To see our previous article, click here.

On 11 September 2019, the Ministry of Finance published Ministerial Decision No. 215 for the year 2019 on the issuance of directives for the implementation of the provisions of the Cabinet Decision No. 31 concerning economic substance requirements (“The Ministerial Decision”). The Ministerial Decision contains guidance on how the Economic Substance Test may be met by Licensees in order to comply with the ESR. The guidance is intended to serve as a guide to entities carrying out one or more Relevant Activities captured by the ESR. In addition, the Ministerial Decision sets out various guidelines on how Regulatory Authorities shall comply with the various functions imposed on them by the ESR and which powers are granted to them to ensure effective execution of the ESR provisions.

Licensees

Every Licensee that carries on a Relevant Activity and derives an income therefrom in the UAE, including a Free Zone or a Financial Free Zone, must meet the Economic Substance Test (article 3.1. and 4.1 of The Ministerial Decision). It seems that licensees carrying on a relevant activity, without deriving any income from that activity, are not in scope of the ESR. The practical implications of this requirement seem rather limited, as most of the Relevant Activities as defined in the ESR (perhaps with the exception of holding activities) are usually carried out for consideration.

The ESR stipulate that its provisions do not apply to entities that are directly or indirectly owned by the Federal Government, or the Government of any Emirate of the UAE or the governmental authority or body of any of them (article 3 (2) of the ESR). The Ministerial Decision now clarifies that the government’s shareholding interest must be at least 51% for the entity to fall outside the scope of the Economic Substance Regulations (article 3.2. and 4.2 of The Ministerial Decision).

Relevant activities

With respect to the Relevant Activities, carried out by Licensees, the Ministerial Decision reiterates that:

The Economic Substance Test

Reporting requirements

Under the ESR, Licensees are required to submit an information notification to the Regulatory Authority, indicating (i) whether or not it is carrying on a Relevant Activity, (ii) whether or not all or any part of the Licensee’s gross income in relation to the Relevant Activity is subject to tax in a jurisdiction outside of the UAE, and (iii) the date of the end of its Financial Year. The Ministerial Decision stipulates that the notification must be made with effect from 1 January 2020.

In addition, a Licensee that is carrying on a Relevant Activity and is required to satisfy the Economic Substance Test, must prepare and submit a report to the Regulatory Authority, no later than twelve (12) months after the last day of the end of the financial year of the Licensee. The Ministerial Decision clarifies that this requirement applies in respect of financial years commencing on or after 1 January 2019.

Each Regulatory Authority shall set out the form of reports to be filed and mechanisms for submitting such forms to the Regulatory Authority.

Meeting the Economic Substance Test

In general, the Economic Substance requirements will be met:

The Ministerial Decision clarifies that the list of CIGA not exhaustive. This means that other activities outside the ones listed in the ESR, which could be considered as (one of) the most important activities of a Licensee, may qualify as CIGA and should therefore be carried out in the UAE. This may also be an indication that a Licensee is not required to carry out all CIGA listed in article 5 of the ESR in relation to a Relevant Activity.

A Licensee’s activity is directed and managed if there are an adequate number of board meetings held and attended in the UAE in relation to that activity. The term adequate is dependent on the level of Relevant Activity carried out by the Licensee. Meetings must be recorded in written minutes which are kept in the UAE and signed by attendees. Quorum for such meetings must be met and attendees must be physically present in the UAE. Directors must have the necessary knowledge and expertise in relation to the Relevant Activity, which entails that their activity is not merely limited to giving effect to decisions being taken outside the UAE. In the event that a Licensee is managed by an individual (e.g. single managing director), the Ministerial Decision states that these requirements will apply to such individual.

The meaning of the term “adequate” in terms of the level of qualified full-time employees, the amount of operating expenditure and physical assets will be dependent on the nature and level of Relevant Activity being carried out by the Licensee in question. A licensee must maintain sufficient records to demonstrate the adequacy in relation to these requirements. Employees must be suitably qualified to carry out the Relevant Activity. Premises may be owned or leased by the Licensee, however, the Licensee must be able to submit the necessary documentation evidencing the right to use the premises.

With respect to outsourcing, the Ministerial Decision clarifies that timesheets can be used to demonstrate the level of employees which are being outsourced in relation to a certain Relevant Activity. Furthermore, outsourcing may not be used with the objective of circumventing the Economic Substance Test.

Retention of information and Records

The ESR do not prescribe a set period for the retention of information and records by Licensees. Taking into account the six-year limitation period for the Regulatory Authority to determine whether a Licensee has met the Economic Substance Test, it is advisable that a Licensee retains any relevant information evidencing compliance with the ESR for a period of six years.

Any records required to be kept and submitted to the Regulatory Authority must be provided in English. In the event that such records are kept in a language other than English, the Licensee shall provide an English translation thereof.

Regulatory Authority functions

The Ministerial Decision provides further detail on how Regulatory Authorities shall comply with the various functions imposed on them by the ESR and which powers are granted to them to ensure effective execution of the ESR provisions.

The Regulatory Authority shall obtain all documentation, records and information from any Licensee which they are required to submit to the Regulatory Authority within the timeframe stipulated in the ESR. The Regulatory Authority shall follow-up promptly with any Licensee in the event of any delay of failure in the submission of required documentation, records and information or in case the latter would prove to be incorrect or incomplete.

In this respect, the Regulatory Authority may:

The Ministerial Decision further provides guidance to Regulatory Authorities on how to determine whether a Licensee has met the Economic Substance Test (e.g. timesheets may be used as a means to verify adequate” employee criterion). In general, the Ministerial Decision states that the Regulatory Authority should adopt a strict yet pragmatic approach to determine whether a Licensee meets the Economic Substance Test.

In case a Licensee fails to meet the Economic Substance Test, the Regulatory Authority shall issue a notice, stating the reasons for that determinations, containing details of any administrative penalty, directing any action to be taken to satisfy the Economic substance Test and advising the Licensee of its right to appeal.

The Regulatory Authority will notify the Competent Authority of each Licensee that fails to satisfy the Economic Substance Test in relation to any activity. The Competent Authority shall provide the submitted information to the Foreign Competent Authority in the event that (i) the Licensee fails to meet the requirements under the ESR for a certain Financial Year, or (ii) the Licensee carries out a High Risk IP Business.

Conclusion

The Ministerial Decision provides some clarification with respect to a number of elements touched upon in the ESR (e.g. which companies are outside of scope of the ESR, the deadlines for the submission of the notification and reports to the regulatory authority, guidance on how to meet the Economic Substance Test). For the most part, however, the guidance merely reiterates the provisions of the ESR. We therefore expect that a large number of companies in the UAE will still have many questions in terms of how to comply with the ESR.

As expected, the Ministerial Decision does not contain one-size-fits-all criteria on how to meet the Economic Substance Test (i.e. in the sense that the Ministry of Finance does not prescribe a specific number in terms of what is considered an adequate number of employees, operating expenditure and physical assets). What qualifies as adequate, will instead depend on the nature and level of the Relevant Activity carried out by the Licensee and it will be up to the latter to provide evidence thereof to the Regulatory Authority.

Another thing worth noting is that the Ministry of Finance has given ample freedom to the Regulatory Authorities to ensure the effective implementation of and compliance with the ESR. Given the fact that every Regulatory Authority has been given the opportunity to determine its own forms and mechanisms for submitting the economic substance reports, in combination with the fact there seems to be some leniency in terms of determining whether a business has met the economic substance test (after all, one Regulatory Authority’s interpretation of what is adequate may differ from another), from a practical point, businesses can expect some level of divergence in terms of how the ESR will be implemented between the different Regulatory Authorities in the UAE.

The UAE is a popular destination for foreign entities to set up their businesses in the Middle East region, amongst others because there is no corporate income tax on the federal level.

In line with international developments around tax transparency, the UAE decided to align its legislative framework with international tax practices by adopting Country by Country Reporting (“CbCR”). The adoption of BEPS Action 13 (introduction of CbCR legislation) is a strong recommendation from the OECD and is part of the wider OECD BEPS action plan and the Inclusive Framework.

Below we list the top 10 things to know for UAE businesses in relation to the new CbCR.

1. What is a Country by Country Report?

The CbCR is a high level report through which multinational groups report relevant financial and tax information, for each tax jurisdiction in which they do business.

2. Who does it apply to?

The reporting is compulsory for multinational groups which are present in at least two tax jurisdictions and which meet the consolidated revenue threshold of AED 3.15 billion (approx. USD 878 million) in one financial year. The subsidiaries of the group need to be linked through common ownership or control.

3. Which entity files the CbCR?

Multinational groups have to establish which entity must submit this report, the i.e. the ultimate parent entity (“UPE”) or a surrogate parent entity (“SPE”). If the tax jurisdiction of the UPE does not have CbCR legislation or does not (automatically) exchange the reports, the tax jurisdiction of the SPE needs to file the CbCR.

The jurisdiction where the CbCR is filed will automatically exchange the information shared in the CbCR with the other tax jurisdictions in which the group is active.

4. If the UAE entity does not file the CbCR, does it have any other obligation?

If the UAE entity is part of a multinational group, it needs to notify the UAE Ministry of Finance of the name of the entity submitting the CbCR and the tax residence of this entity before the last day of the financial reporting year (31 December 2019 for the first year). There is no formal process in place yet for notifying MoF of this.

5. When do we submit the CbCR?

The CbCR regulations came into effect as of 1 January 2019, this means that for the financial year ending 31 December 2019, the CbCR must be submitted at the latest by 31 December 2020, and annually thereafter.

6. What information should we provide?

The CbCR needs to include the amount of revenues, profits (losses) before income tax, income tax paid, income tax payable, declared capital, accrued profits, number of employees, and non-cash or cash-equivalent assets for each country.

7. What will the CbCR be used for?

The CbCR allows tax authorities around the world to automatically exchange information on taxable profits in different tax jurisdictions. The information allows the tax authorities to make a first assessment before highlighting risk jurisdictions in which too little tax is being paid.

Given the current absence of Federal Corporate Income Tax, the UAE authorities will not have a particular interest in the CbCR. Other States however will be interested in what the UAE subsidiary of the international group is reporting.

8. How long do we keep the information?

The relevant records need to be maintained until 5 years after submitting the CbCR. The records can be kept electronically and in English.

9. Is there a format for submitting the CbCR?

The report should be in the same format as per the OECD guidelines. Click here for Appendix C of OECD’s guide for reference.

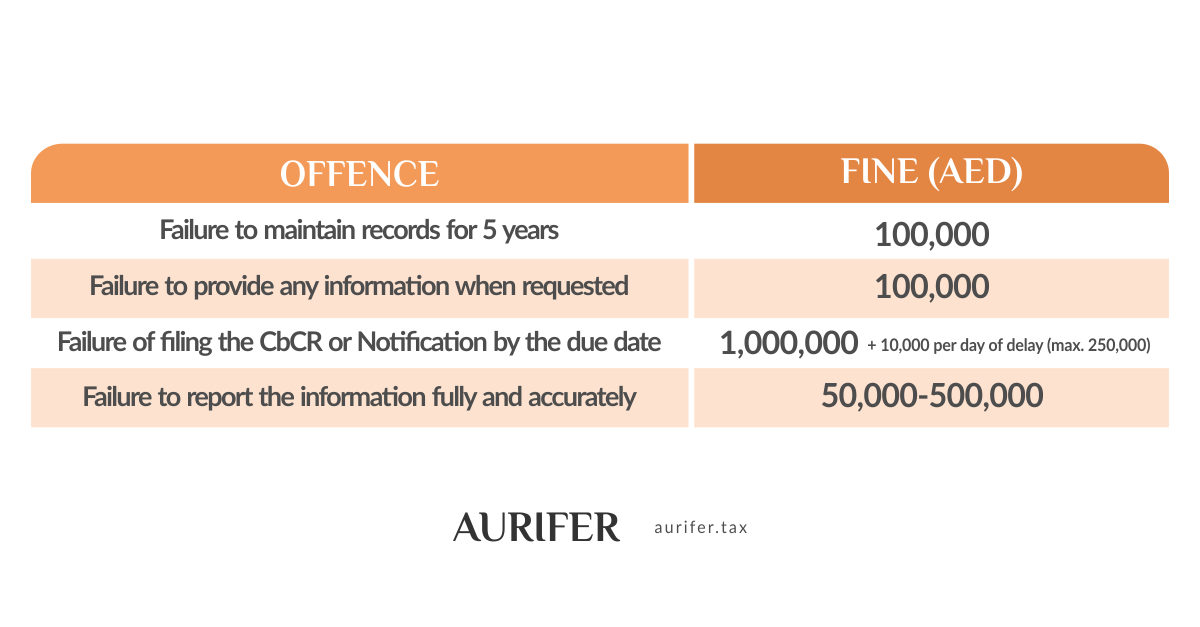

10. Are there any penalties for non-compliance?

(See above table)

Except for the additional daily penalty, the total fines imposed may not exceed AED 1,000,000 in one financial year.

© Aurifer

Developed By Volga Tigris Digital Marketing Agency