10 Highlights on the Updates to the UAE VAT Executive Regulations Effective 15 November 2024

On Friday, October 4, 2024, the Federal Tax Authority (FTA) released the English version of Cabinet Decision No. 100 of 2024, with an issuance date of 6 September 2024, amending the provisions of UAE VAT Executive Regulations (The Executive Regulation of the Federal Decree-Law No. 8 of 2017 on Value Added Tax, Cabinet Decision No. 52 of 2017 – Issued on 26 November 2017 as amended till date). The publication follows the FTA’s earlier release of an Arabic version on October 2, 2024.

The updated version of the UAE VAT Executive Regulations (UAE VAT ERs) will enter into force on November 15, 2024. In total, 35 changes have been made, covering 34 articles. Although it is not the first time that the UAE VAT ERs have been amended (the last amendment was made through Cabinet Decision No. 99 of 2022 – Issued on 21 October 2022 and Effective from 1 January 2023), such an extensive overhaul is unprecedented in UAE VAT.

Aurifer has singled out 10 highlights regarding the recent amendments to the UAE VAT ERs, promising more in-depth coverage in the coming weeks. Noteworthy, the FTA has not yet published guidance on its interpretation of the planned changes. Therefore, the following analysis needs to be read with some caution.

1. Zero Rating Exports of Goods

Article 30 UAE VAT ERs has been changed to clarify the documentation that should be retained as evidence for the direct/indirect export or customs suspension of goods.

The documents to be used as evidence may include 1) a customs declaration and commercial evidence proving the export of goods, 2) a certificate of shipment and official evidence proving the export of goods, or 3) a customs declaration proving the customs suspension situation. The article has also expanded the definitions of official evidence, commercial evidence, and certificate of shipment.

This update is essentially meant to align the documentation for proof of export of goods more closely with recent changes in UAE Excise Tax legislation. The change seems to reflect a more practical approach, compared to the strict approach the FTA had used in the past of requiring “exit certificates” in almost all cases for exports of goods.

2. Zero Rating Exports of Services

Article 31 UAE VAT ERs now lists a further condition for a supply of services to qualify for zero rating.

Notably, Article 31(1)(a)(3) UAE VAT ERs provides that “[t]he Export of Services shall be zero-rated … if … the Services are not treated as being performed in the State or in a Designated Zone under Clauses 3 to 8 of Article 30 and Article 31 of the Decree-Law”.

This update aims to clarify that a service cannot be considered provided outside the UAE and, therefore, zero-rated if it refers to a service for which special place of supply rules apply, such as restaurant and cultural services or telecommunication and electronic services. These amendments seem to be more clarifying, as this was already how the FTA was administering the provision.

3. Virtual Assets

Article 1 UAE VAT ERs provides a new definition of virtual assets, which includes any “[d]igital representation of value that can be digitally traded or converted and can be used for investment purposes”, although not including “digital representations of fiat currencies or financial securities”. This seems to include virtual assets such as NFTs and cryptocurrencies, except potentially for e-money and perhaps stablecoins because of the reference to “digital representations of fiat currencies”.

In parallel, Article 42 UAE VAT ERs has been amended with paragraph 2 listing 3 activities considered financial services: 1) “The transfer of ownership of Virtual Assets, including virtual currencies” (letter k); 2) “the conversion of Virtual Assets” (letter l); and 3) “Keeping and managing Virtual Assets and enabling control thereof” (letter m).

While the first two activities are VAT-exempt, even with retroactive effect from 1 January 2018, the VAT treatment of “Keeping and managing Virtual Assets and enabling control thereof” seems to be subject to the standard VAT rate. Therefore, fees charged for wallet and custodial services seem to follow the general rules.

There have been no changes for brokers, but the legal framework seems to have been clarified for most virtual assets. Given the dynamic behind the crypto space, this may not be the last change, and the regulatory framework often plays catch-up.

Aurifer has previously commented on the tax treatment of cryptocurrencies and associated services here, and it looks like the UAE may have drawn some inspiration from these comments.

4. Management of Investment Funds

Financial services listed in Article 42(2) UAE VAT ERs now include (letter j) “the management of investment funds”, which means ‘services provided by the fund manager independently for a consideration, to funds licensed by a competent authority in the State, including but not limited to, management of the fund’s operations, management of investments for or on behalf of the fund, monitoring and improvement of the fund’s performance’.

When the UAE introduced VAT, many UAE fund managers mistakenly interpreted this provision or omitted to charge VAT on the management fee. The extra costs often impacted returns for investment funds that did not have a full right to recover input VAT.

It often led to important disclosures for the fund managers, and there was extensive discussion on the VAT treatment of carried interest. The amended provision now makes a legal U-turn and applies a VAT exemption for UAE fund managers going forward. Fund managers will need to identify the types of income streams they have. If there are no other income streams, fund managers will need to deregister for VAT purposes, which may trigger VAT corrections.

From now on, if fund managers have no other income, they will be unable to claim input VAT. This will increase their operating costs, but funds will have less potentially non-deductible VAT at their level.

5. Input VAT Recovery on Employee Related Expenses

Article 53 UAE VAT ERs now allows a taxable person to deduct input VAT paid on medical insurance for their employees and their dependents.

Input VAT recovery is limited to health insurance for the employee’s spouse and up to three children under 18. Enhanced health insurance also becomes VAT recoverable as an exception to the general non-recoverability of employee-related expenses when it is provided at no charge and for the employee’s personal benefit.

The update clarifies the deductibility, extending an employer’s possibility of recovering input VAT relating to medical insurance for its employees and their dependents, possibly beyond the case in which a legal obligation to that effect exists.

6. Tax Deregistration to Protect the Integrity of the Tax System

Article 14(bis) UAE VAT ERs has been added, enabling the FTA’s power to issue tax deregistration decisions for taxable persons if the continuity of their tax registration may prejudice the integrity of the tax system.

The article provides various conditions for the deregistration decision to be issued, which FTA must verify before completing a taxable person’s deregistration.

This update confirms the FTA’s authority to monitor eligibility conditions and the correct application of UAE VAT legislation. It allows for the FTA to remove perhaps old and inactive VAT registrations.

7. Composite Supplies

Paragraph 1(b) has been added to Article 46 UAE VAT ERs, clarifying the VAT treatment applicable to composite supplies where no principal and ancillary components can be singled out (reference is to Article 4(3)(b) UAE VAT ERs).

The new paragraph now provides that “[i]f a single composite supply does not contain a principal component, the Tax treatment shall, generally, be applied based on the nature of the supply as a whole”.

This update aligns with the treatment provided under European VAT regarding a single composite supply consisting of components having “equal status” (CJEU, Bastova, Case C-432/15).

8. Government Buildings Exceptions

New Article 3(bis) UAE VAT ERs has been added, listing exceptions to supplies in case of transactions involving, respectively, 1) the grant or transfer of ownership or disposal of governmental buildings, real estate assets, and similar projects between governmental bodies and 2) the grant or transfer of the right to use, exploit, or utilise governmental buildings, real estate assets, and similar projects between governmental bodies.

Importantly, the new no-supply rules apply retrospectively, starting from 1 January 2023. The new article also provides a list of categories that should be considered governmental buildings, real estate assets, and other projects of a similar kind.

It is not immediately clear which specific provision under the UAE VAT Law or the GCC Agreement this new article intends to implement.

9. Exceptions Related to Deemed Supplies

As an exception to the application of provisions concerning deemed supplies, Article 5 UAE VAT ERs now provides that if the value of the supply of goods to each recipient within a 12-month period does not exceed AED 500, then it is not a deemed supply. Reference to samples or commercial gifts has been removed from the text of Article 5 UAE VAT ERs, but it is still contained in Article 12(4) of the UAE VAT Law.

A deemed supply is also not triggered for supplies where the outstanding VAT amount does not exceed AED 250,000 (equal to supplies of up to AED 5M), provided the supplier and the recipient are government bodies or charities. Any excess amount is subject to VAT.

This update implements the exceptions from deemed supplies listed in Article 12(4) and (5) of the UAE VAT Law

10. Improved input VAT recovery methods for partially exempt businesses

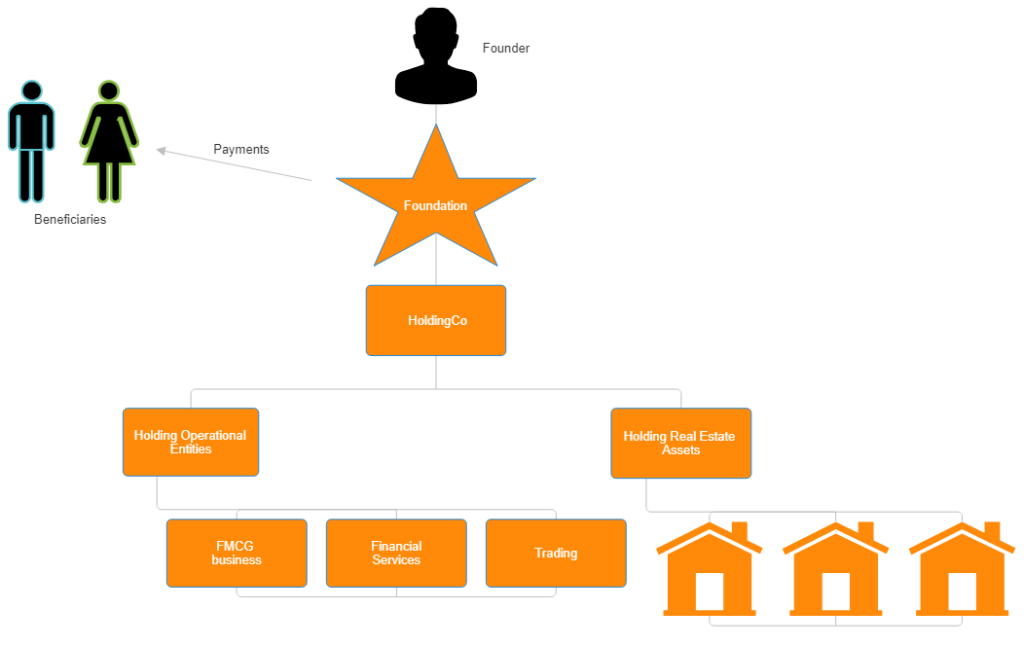

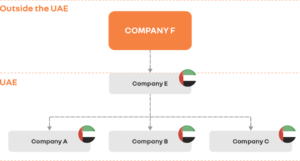

Article 55 UAE VAT ERs introduces more flexibility for partially exempt businesses to determine a more suitable way of determining their input VAT recovery.

Partially exempt businesses may include financial institutions, real estate companies, and local transport companies.

Notably, the UAE suggests introducing a Singapore-inspired fixed recovery ratio to determine the input VAT recovery (although not sector-based). In this way, the UAE is making additional exceptions to its general input VAT recovery method without overhauling the standard procedure.