10 common reasons why businesses fail the Economic Substance Regulations Obligations

Bahrain and the UAE introduced a legal framework requiring businesses to have substance in their jurisdictions as a direct consequence of the Organisation for Economic Co-operation and Development’s (“OECD”) ongoing efforts to combat harmful tax practices under Action 5 of the Base Erosion and Profit Shifting (“BEPS”) project.

Since a number of years, the European Union publishes a list that focused on jurisdictions which may potentially be harmful to the fiscal interests of the Member States of the European Union (“EU Blacklist”). This blacklist included countries like the Bahamas, Bermuda, the British Virgin Islands (BVI), Cayman Islands, Guernsey, Isle of Man, Jersey and the UAE. In an attempt to see itself removed from the EU Blacklist, the UAE introduced Economic Substance Regulations (“ESR”) with effect from 30 April 2019. In the same year, Bahrain also introduced ESR Requirements with the same purpose.

Accordingly, Bahraini businesses and UAE onshore and free zone entities that carry on specific activities mentioned in the regulations will need to examine whether they meet the economic substance requirements. These specific activities are either highly mobile activities (e.g. licensing intellectual property, services centers, holdings, …) or tightly regulated activities (e.g. banking, insurance, …).

Businesses in scope of the ESR in the UAE must meet the Economic Substance Test. The test includes the following:

- The licensee conducts core income generating activities in the UAE;

- The licensee is directed and managed in the UAE;

- The licensee has an adequate number of full-time employees in the UAE;

- The licensee incurs an adequate amount of operating expenditure in the UAE; and

- The licensee has an adequate amount of assets in the UAE.

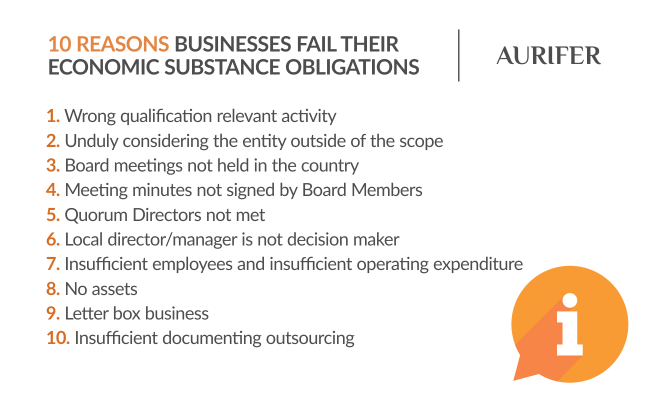

With ESR reports for the non financial sector in Bahrain for 2019 just submitted end of June 2020 and around five months left for the submission of the first ESR reports to the respective Regulatory Authorities in the UAE, we have highlighted the top 10 reason businesses fail to meet their obligations under the ESR in the UAE and in Bahrain.

1. Wrong qualification relevant activity

The relevant activities in the scope of ESR can sometimes be tricky to analyze. For example, if a company undertakes a headquarters business in the UAE, the definition of the relevant activity includes providing ‘senior management services to one of more foreign connected persons’. There is not a great deal of detail known on how to interpret this criterion and it may be complicated to assess.

Similarly, such a business may also qualify as a distribution and service centre business as it provides ‘services to foreign connected persons in connection with a business outside UAE’ (i.e. a foreign subsidiary). The definition of a service centre business in the UAE is extremely wide and catches many more businesses than one would expect.

In such cases, the Relevant Activities guide and the FAQs published by the Ministry of Finance is helpful to determine whether the licensee falls within the scope of both the relevant activities and based on which relevant activity must the ESR test be fulfilled and must be reported. In this case the licensee will have to meet the ESR test only for the headquarters business and not the distribution and service centre business. However, it is still unclear how this will be conveyed in the ESR report.

Another example relates to intra group financing. Although these businesses provide financing and fall inside the scope of ESR, they may encounter practical difficulties of identifying their appropriate relevant activity and regulatory authorities.

2. Unduly considering entity outside of the scope

Licensees in the region sometimes assume that, since their trade license does not mention any of the relevant activities, the entity is outside the scope of ESR. The ESR regulations however adopt a ‘substance over form’ approach. Therefore, irrespective of the activities mentioned in the trade licence, if any licensee carries out any of the relevant activities, they are in the scope of ESR.

3. Board meetings not held in the country

It is common practice in the UAE and Bahrain that board meetings are held via conference calls as a majority of the board members may not be based in the Gulf. The number of board meetings will be dependent on the level of Relevant Activity carried out by a licensee. However, for example in the UAE, it is expected that at least one meeting is held in a financial year in the UAE.

It may also be required to meet the minimum requirement under the law applicable to the licensee or in the constitutional documents of the licensee.

4. Meeting minutes not signed by Board Members

In the UAE, it is also required that these meeting minutes are signed by the directors that are physically present at the meeting and these minutes must be kept in the UAE.

5. Quorum directors not met

If board meetings are held in the UAE it is essential to maintain the Quorum as per the law applicable to the licensee or as set out in the constitutional documents of the licensee.

This goes hand in hand with the requirement to maintain meeting minutes as the meeting minutes can prove that relevant decisions are taken in the UAE and that the required number of directors were present to meet the quorum for the board meeting.

It should be noted that, the UAE Ministry of Finance has notified that it will take the effect into consideration of the COVID-19 travel, quarantine and self-isolation restrictions while determining whether the ‘directed and managed’ criteria is met for the reporting year 2020.

6. Local director/manager is not decision maker

Sometimes directors or managers are appointed just to meet regulatory requirements and they only give effect to decisions taken outside the UAE. In this case, the ‘directed and managed in the UAE’ criteria for the Economic Substance Test will not be met.

As per the ministerial decision, the board or manager must have the necessary knowledge and expertise and ensure that they do not merely give effect to decisions that were taken outside the UAE. This criteria may not be fulfilled when there are only a limited number of directors in the UAE and if their role does not relate to the relevant activity.

7. Insufficient employees and insufficient operating expenses

According to the ESR, the licensee must demonstrate that it has an adequate and appropriate number of qualified full-time employees engaged in the relevant activity and that these employees are physically present in UAE. Similarly, sufficient operating expenses must also be incurred in the UAE depending on the level of activity in the UAE.

However, the term ‘adequate’ and ‘appropriate’ is subjective and it depends on the nature and level of the relevant activities conducted by the licensee. Additionally, the regulatory authority may have its own minimum requirement for the purposes of receiving a valid trade license. For example, it may be appropriate for a holding company business to not have any full-time employees or office premises in order to conduct this business.

8. No assets

The ESR also requires the licensee to have adequate physical assets for the relevant activity. This requirement mainly relates to procuring adequate premises to carry out a Relevant Activity in the UAE. Premises can include offices or other form of business premises depending on the nature of the Relevant Activities. Furthermore the premises may be owned or leased by the licensee.

This means that businesses with ‘flexi-desk offices’ in the UAE conducting a holding company business may meet the criteria of adequate sufficient premises. In contrast, a business that conducts a headquarters business responsible for the GCC region may at least require regular office premises in the UAE.

9. Letterbox business

The ESR is mainly aimed at such entities as they do not have sufficient substance in the UAE. These ‘letterbox’ entities are usually established in a Free Zone with minimal operating expenses and no premises. The purpose of these entities is mainly to be the middleman in different international transactions for the purposes of shifting profits and reducing the burden of taxes.

10. Insufficient documenting outsourcing

A licensee may satisfy the sufficient activities, employees, operating expenditures and/or premises criteria for the Economic Substance Test, if they are provided by a third party. These functions can be outsourced provided sufficient documentation is maintained and the activities are undertaken in the UAE.

Additionally, the licensee must be able to demonstrate its ability to supervise the carrying out of CIGA by the third party service provider (where applicable) as the licensee remains responsible for accurate reporting at all times.

It is likely that the majority of licensees may not have sufficient documentation that can be provided to the Regulatory Authorities in this respect.

Consequences of failing to meet the test

First time failures to meet the Economic Substance Test, will attract a penalty ranging from AED 10,000 to AED 50,000. Any subsequent failure will attract a penalty ranging from AED 50,000 to AED 300,000 (article 10 of the ESR).

The authority could also impose additional penalties and sanctions which may include the suspension, revocation or non-renewal of the entity’s business license.

If the Regulatory Authority determines that the licensee does not meet the Economic Substance Test and notifies the licensee of this, this information can also be exchanged with the foreign competent authority where the Ultimate Parent Entity or the Ultimate Beneficial Owner resides in or where the foreign licensee is incorporated. This may lead to tax audits or to certain tax benefits being denied.

Licensees should start early in terms of analysing whether they meet the Economic Substance Test for the year ending 2019.

Even if there is no way to remedy the past, it is better to implement the necessary measures as soon as possible. This in turn will enable the licensees to meet the Economic Substance Test for the next financial year.