Tax exemptions for KSA Regional Headquarters

The Kingdom of Saudi Arabia (KSA), as part of Vision 2030, aims to diversify its economy and reduce its dependency on fiscal resources stemming from commodities.

Amongst others, Vision 2030 focuses on attracting more Foreign Direct Investment. It does so through incentivizing businesses to establish themselves in KSA. Additionally, subject to certain conditions, only businesses which are incorporated in KSA can still tender for contracts with the government and government agencies (i.e., any entities or agencies with public legal personality in KSA) from 1 January 2024.

The introduction of the Regional Headquarters Program (“RHQ”) fits in with Vision 2030. This joint initiative between the Ministry of Investment (“MISA”) and the Royal Commission for Riyadh City (“RCRC”), invites global companies with a presence in the MENA region to relocate their regional headquarters to the KSA, promising accessibility to the ever-expanding economy of Saudi Arabia and to be part of the 2030 strategic development goals.

Regional headquarters by definition refers to “the home or center of operations, including research and development, of a national or multinational corporation with no retail sales to the general public”. The eligibility requirements and further details for an RHQ are outlined by Invest Saudi, and can be found here.

Based on what is already known so far, the program offers a range of benefits and facilities for RHQs in KSA, although it remains to be seen at this stage whether RHQs will get to enjoy any tax holidays or incentives. Although often rumored, there is currently no legal framework to award such tax exemptions, until further notice.

This, in turn, brings the tax consequences in focus of setting up an RHQ in KSA. By nature, the RHQ will be a location for strategic and management functions, and possible support services. This triggers proper tax consequences. This article provides an overview of the tax implications following the setup of the RHQ in KSA within the context of the existing KSA corporate income tax framework.

Taxable revenue generated by the RHQ

For those that establish an RHQ in KSA, the legal entity through which the RHQ license will be operated, will be considered a tax resident in KSA based on its place of incorporation. If this is an LLC, its worldwide income is subject to tax in KSA.

The fact that its C-suite, and therefore assumed to be the decision makers, may potentially not be resident in KSA effectively, or take decisions outside of KSA, has no bearing on the tax residency of the RHQ, which is simply a KSA tax resident.

If, however, the place of effective management of such an entity is outside of KSA, the entity may have a second residency, which may create additional issues outside of KSA in the country where the entity would be considered as having a second residency.

Setting up the RHQ as a branch, and not as an LLC has its own challenges, especially around profit allocation.

While from a regulatory point of view the RHQ license does not permit commercial activities, the revenue generated will be subject to corporate tax in KSA. Under the existing corporate income tax framework, 20% corporate income tax will apply on the taxable income generated by the RHQ.

Given that the RHQ is aimed mainly at foreign investors, while a theoretical possibility, it is unlikely that the entity will be held by GCC nationals such that zakat will apply on its zakat base at a rate of 2.5% (the zakat base is calculated differently than taxable income for corporate income tax purposes).

While the entity’s activity is not of a commercial nature, from a tax point of view, it has key strategic functions sitting in KSA. The entity needs to comply with transfer pricing rules and needs to be remunerated for its functions. An entity which is a pure cost center and is therefore loss making continuously is not permissible from a transfer pricing point of view, not desirable and is likely to trigger an audit.

The RHQ’s functions, assets and risks will need to be analysed, and likely the outcome will be that its strategic functions need to be remunerated at arm’s length determined through a benchmarking analysis, while its less strategic functions, such as back office functions, would be considered as low value intra group services (“LVIGS”), where the nature of such services is considered supportive and supplementary rather than an element of the core business of the Group.

The OECD have a safe harbour for LVIGS transactions which include accounting and auditing, tax and legal services, IT services (when not part of the principal activity of the group), HR activities etc. KSA has endorsed those Guidelines.

Where services meet the definition of LVIGS, a simplified approach may be available, which would see the appropriate cost base identified for the LVIGS activities be recharged with a profit markup of 5% with no requirement for a full benchmarking analysis to support the arm’s length nature of same. However, documentation should be retained which supports the rationale for the treatment of the activities as LVIGS. This includes a Master File and Local File where intercompany transactions exceed 6M SAR annually.

Below is a table of the mandatory activities under the RHQ license, and the optional ones.

|

Mandatory RHQ Activities – Strategic direction |

Mandatory RHQ Activities – management functions |

Optional RHQ Activities |

|

Formulate and monitor regional strategy |

Business planning |

Sales and Marketing Support |

|

Coordinate strategic alignment |

Budgeting |

Human Resources, and Personnel Management |

|

Embed products and/or services in region |

Business coordination |

Training Services |

|

Support M&A |

Identification of new market opportunities |

Financial Management, Foreign Exchange, and Treasury Centre Services |

|

Review financial performance |

Monitoring of the regional market, competitors, and operations |

Compliance and Internal Control |

|

Marketing plan for the region |

Accounting |

|

|

Operational and financial reporting |

Legal |

|

|

Auditing |

||

|

Research and Analysis |

||

|

Advisory Services |

||

|

Operations Control |

||

|

Logistics and Supply chain management |

||

|

International Trading |

||

|

Technical Support or Engineering Assistance |

||

|

Network Operations for IT System, |

||

|

Research and Development |

||

|

Intellectual Property Rights Management |

||

|

Production Management |

||

|

Sourcing of Raw Materials and Parts |

Other pitfalls for newly incorporated RHQ’s?

KSA residents are obliged to withhold a tax from the amounts payable to non-resident entities for services (“WHT”). WHT applies on the gross income sourced by the non-resident entities from KSA at the time of payment by the KSA resident customer. The rate applied to the payments ranges between 5% to 20%, depending on income types.

However, subject to the double taxation treaties (“DTTs”) entered with KSA, non-residents from countries that have treaties with KSA may be able to avail of a WHT exemption or relief on the income generated. KSA has entered DTT’s with numerous countries outlining the extent to which tax may be charged and the potential relief available on the WHT application pertaining to profit repatriation, dividend, interest and royalty payments, among a few others. The list and overview of DTT’s can be found here.

KSA additionally has wide Permanent Establishment concepts, covering amongst others virtual Permanent Establishments. KSA also has a Force of Attraction principle, widening the scope of any profits allocated to a Permanent Establishment. This exceptional position from an international point of view tends to constitute more of an issue with non-treaty countries.

The Financial Times has recently published an article found here, which refers to how the taxation uncertainty is “paralyzing some people from doing things”, with fears among executives revolving around how the setting up of the RHQ in KSA could potentially give rise to a tax creep on the regional profits generated outside of KSA, allowing KSA to tax such profits under its domestic tax legislative, in the absence of tax treaties between KSA and other countries in the region.

These concerns are partially unfounded. If the activities described above are conducted in KSA, no other countries would be entitled to tax them. Their very nature would not make them particularly prone to Permanent Establishment risks elsewhere (although there may be residency risks elsewhere).

Where there is more of a valid concern, is around passive income, where DTT’s may help in reducing potential foreign withholding taxes and establishing a method for double tax relief to be used in KSA. It is therefore important that KSA continues to develop its DTT network.

Value Added Tax (“VAT”) considerations

In general, the place of supply in respect to both goods and services determines the applicable VAT regime. The supply of services by a KSA resident entity, including an RHQ, to a non-resident customer, who benefits from the service outside the GCC territory, is in principle subject to zero-rate for KSA VAT purposes. In order to apply the zero-rate, the supplier must ensure it can meet each of the criteria set out in Article 33 of the VAT Implementing Regulations.

This treatment should be appropriately accounted for in any invoices issued by the RHQ to its affiliates. Additionally, it will be important for the RHQ to monitor the activities/supplies undertaken in KSA which are subject to VAT and whether they will exceed the standard threshold of 375,000 SAR, requiring them to register for VAT in KSA.

Concluding thoughts

There is currently no tax exemption available for RHQ activities. The taxation of RHQ activities therefore has no specific angle to it. The attention point mainly turns towards Transfer Pricing and the appropriate arm’s length remuneration for RHQ activities. Given the potential mix of strategic, management and back office activities, these arrangements need to be analysed and appropriately remunerated.

We will potentially see more clarification from ZATCA or from MISA on the aspects of the RHQ program soon, and definitely more interest, given the very fast growth KSA is currently going through, and the multitude of megaprojects and smaller projects being developed.

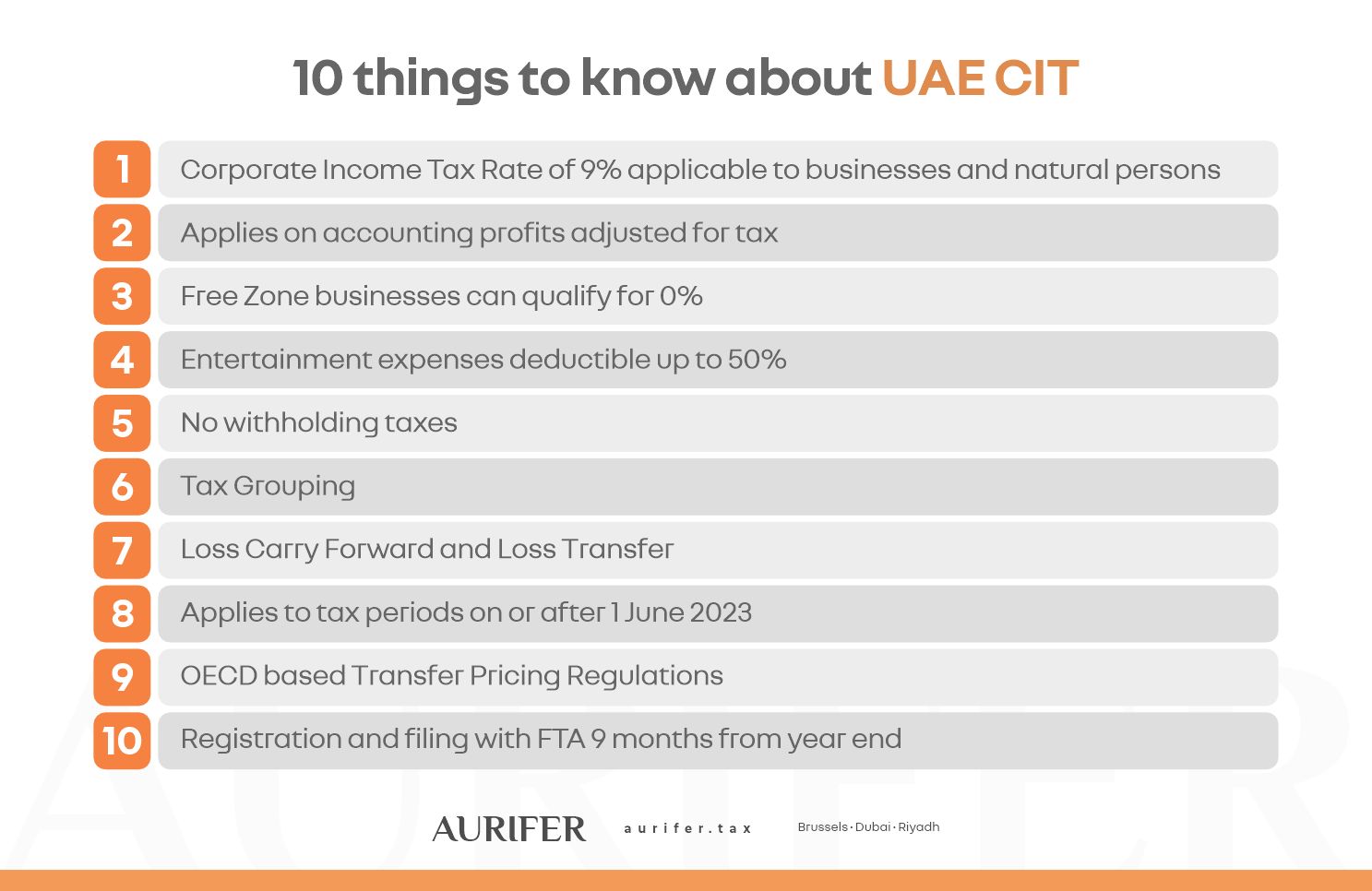

As we have seen in the UAE for Qualifying Free Zone Persons, even if benefits are granted (0% in the case of the UAE), transactions need to comply with transfer pricing. Therefore, even if eventually RHQ’s are granted a tax holiday, the transfer pricing principles will remain very relevant.