Mechanical Impact

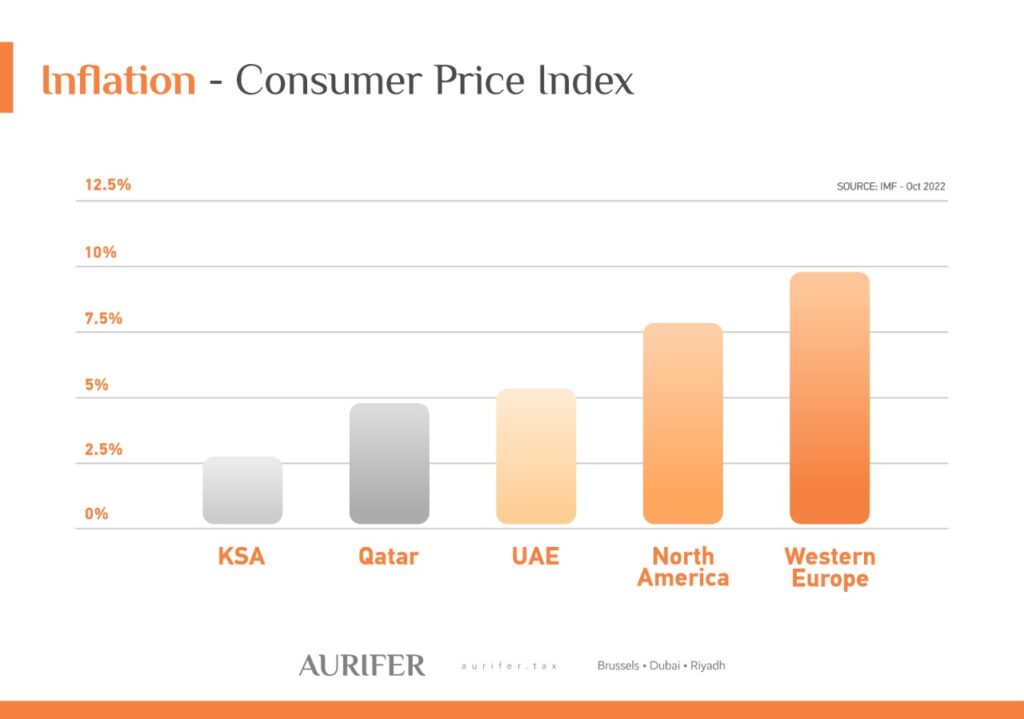

As outlined above, inflation can have a significant financial impact on businesses. The relative impact of inflation on the mechanical operation of a group’s transfer pricing policy is dependent on the nature of the intercompany arrangements, as well as the transfer pricing methodology applied.

For example, a Limited Risk Distribution (LRD) entity that is remunerated with a fixed operating margin (operating profit/revenue) may require a manual transfer pricing adjustment at year-end to account for inflation, to ensure that the LRD’s margin remains aligned with the transfer pricing policy.

In contrast, where an entity performs contract manufacturing and is remunerated with a mark-up on its cost, any increase in the underlying cost base as a result of inflation should automatically be reflected in the contract manufacturer’s return, as the basis of remuneration (i.e., cost) correlates with the impact of inflation.

However, although a cost-plus return may not be disrupted from the perspective of the contract manufacturer, the higher cost base will impact the profit margin of the counterparty compared to forecasts. Below, we discuss the impact of inflation on the group and how to effectively manage these negative impacts.

Allocation of Risk, Reward and Downside Impact

Under the arm’s length principle, the attribution of business profit amongst group entities should be aligned with each entity’s relative contribution to the functions, assets, and risks of the business.

In this regard, group entities that perform high-value functions and/or assume, control, and have the financial capacity to bear the key market and other operational risks are rewarded with an entrepreneurial return. An entrepreneurial return is typically the residual system profit after rewarding related parties that perform routine activities with a fixed return (“routine returns”).

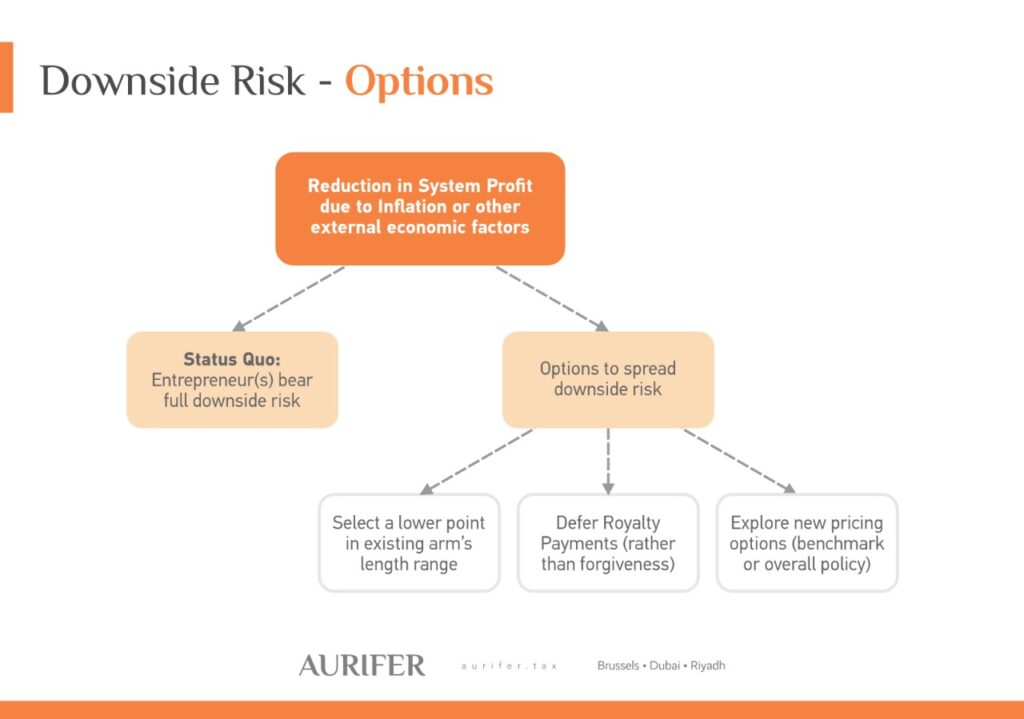

Under both examples discussed above, we considered how transfer pricing policies adapt to the impact of inflation from the perspective of maintaining the remuneration profile of the routine return entities. However, where the system profit is substantially reduced as a result of inflation or wider economic downturn, the question arises whether the existing remuneration policy remains fit for purpose and appropriately rewards each entity for its relative contribution to the group’s activities.

Under first principles, an entrepreneurial entity that retains any upside on the residual system profit should equally bear the downside risk associated with inflation/economic downturn on group profit. However, as often is the case in transfer pricing, nothing is ever so black and white.

For example, there may be commercial, regulatory, or capital requirements that could impact the entrepreneur (and the business as a whole) which would necessitate an adjustment to the group’s pricing policies to reflect market conditions. In these circumstances, an independent enterprise acting at arm’s length would be expected to re-negotiate existing arrangements to protect themselves from such consequences.

In this regard, there are a number of methods that could be employed to effectively spread downside risk amongst related parties while maintaining the arm’s length principle:

- Selection of a lower point in the arm’s length range. The selection of a point within the interquartile range may be appropriate. An adjustment should be applied in accordance with the terms of the intercompany agreement and supported by robust documentation outlining the rationale for the adjustment, as it is likely to be challenged from the local tax authority of the routine entity.

- Defer payments until a recovery in economic circumstances. This situation may be more relevant for royalty license arrangements. Rather than a complete forgiveness of a royalty payment, a licensor may allow licensees to defer payment until such time as the economic circumstances have improved. Again, consideration to the terms of the existing intercompany agreement and appropriate support documentation is required. It may be appropriate for the licensor to apply a small portion of interest, as the characterization of the arrangement may take the form of a loan or working capital balance.

- New transfer pricing policy/benchmarking. Performance of an updated benchmarking or implementation of a new operating model may result in a more equitable distribution of profits/losses between group entities.

The appropriateness of the above options will depend on each business’s specific facts and circumstances, the risks for which each entity is responsible, the impact of inflation on system profit etc. We would advise that these points are considered and addressed pro-actively, as retrospective adjustments may be more likely to be challenged by tax authorities.