The UAE introduced VAT with effect from 1 January 2018. It based its legislation on the GCC VAT Treaty, which is based on the EU VAT directive, and loosely on a few other jurisdictions. The rules were established in 2017. These were untouched until recently.

For the first time in 2.5 years after the introduction of VAT, the United Arab Emirates (‘UAE’) updated its legislation. The UAE’s Federal Tax Authority (‘FTA’) published an updated version of the VAT Executive Regulations (‘ER’) to the VAT Federal Decree-Law.

The updated version incorporates the changes as per a new Cabinet Decision No. 46 of 2020 (Official Gazette issue 680 of 2020 published on 15 June 2020). The updated version amends one article (article 31 (2)) and improves the English translation in a number of places (e.g., article 51 (5) and article 70 (4). It has flagged only the amendment and not the improvements to the translation. According to the UAE constitution, the amendments enter into effect one month after publication.

This article discusses the change, compares it with KSA and the EU, and analyses the practical complexities and formalities.

Restricting the scope of zero rated exported services

The UAE Federal Cabinet decided to amend one single, but important word. It changed “or” into “and”. The amendment was made to the conditions for considering a recipient “outside of the State”. That condition is necessary in order to consider the services “exported” and therefore zero rated. The amendment highlighted by the FTA was made under Article 31 (2).

For the purpose of paragraph (a) of Clause (1) of this Article, before the amendment the law said, a Person shall be considered as being “outside the State” if they only have a short-term presence in the State of less than a month, or the only presence they have in the State is not effectively connected with the supply.

Now, after the change in law, for the purpose of paragraph (a) of Clause 1 of this Article, a Person shall be considered as being “outside the State” if they only have a short-term presence in the State of less than a month and the presence is not effectively connected with the supply.

Article 31 (2) and (3) of the UAE VAT ER were inspired by the New Zealand GST Act. This can be rather ascribed to a coincidence than a conscious policy choice. Conceptually the NZ GST Act is very different from the GCC VAT Treaty, which is based on the European Union VAT directive (in the UK sometimes informally referred to as the “Principal VAT Directive”).

The NZ’s GST Act also says for the same provision “or”, like in the original text of the UAE VAT ER (see Article 11 A 3 of the NZ GST Act). Note that the examples given by the NZ tax authority for the application of the condition under which the zero rate cannot be applied are very simple, showing that the intended reach is not wide (see https://www.ird.govt.nz/gst/charging-gst/zero-rated-supplies, consulted on 9 July 2020).

How are services ‘exported’?

To the experienced European VAT adviser the term “exported services” sounds like a badly tuned violin. Yet it is what is referred to as the situation where a service supplier has a customer who is not established in the same country. In that situation, the taxation rights are for the country of the customer, and not the supplier.

In the UAE, this is translated into a long list of requirements. A supply is ‘zero rated’ when the service is supplied to a recipient who does not have a place of residence in an implementing state (GCC countries) and is outside the State at the time the service is performed. Additionally, the service must not be supplied directly in connection with real estate or moveable personal assets situated in the UAE.

Furthermore, services are also subjected to the zero rate in the UAE if they are actually performed outside the implementing states or are the arranging of services that are actually performed outside the implementing states (note that these conflict with the place of supply rules and also overlap with article 54, 1, b of the UAE VAT law). If the supply consists of the facilitation of outbound tour packages, it can also be zero rated.

It is important to note that currently, the UAE does not recognize any of the other GCC countries as an ‘implementing state’. Therefore, ‘outside the State’ also includes customers with a place of residence in other GCC countries.

Comparing zero rates for “exported services”

As a comparison, article 44 of the EU VAT directive simply locates any service rendered to a taxable person abroad in the other country. This place of supply rule is the equivalent of the so-called “export of services”. There is no further restriction to this rule, except to prevent double taxation (article 59a of the EU VAT directive). The “best in class” is therefore very liberal in awarding the ‘zero rate’ to services rendered to a recipient outside of the country of the supplier, when the customer is a taxable person.

Article 45 of the same EU VAT directive locates services which are not rendered to a taxable person in the country of the service supplier (unless amongst others article 59 applies).

The export of services in the UAE applies, irrespective of the status of the customer, whereas in the EU it only applies when dealing with a business customer. If the UAE wanted more revenue, then this was perhaps a place to look for it.

The GCC VAT Treaty prescribes almost the exact same thing as the EU VAT directive and is almost identical in its wording (see articles 15 and 16 of the GCC VAT Treaty, which bear very strong similarities with respectively articles 45 and 44).

The GCC VAT Treaty may however have induced some people in error by using the word ‘taxable customer’ in article 16, which is not a defined term and which should be read equally broad as the term ‘taxable person’ in the Treaty. Note that the GCC VAT Treaty knows no so-called ‘export of services’ and therefore, the rules were likely to be intended to apply as in the EU.

The GCC VAT Treaty does have a cryptic article 34, d, which can actually be considered unnecessary as it solely confirms the rules as they are described above in the Treaty.

KSA has been struggling with the same provision from the GCC VAT Treaty, although it conveniently and surprisingly simply incorporated a Treaty into its domestic laws.

It initially translated article 15 and 16 of the GCC VAT Treaty into article 33 of the Implementing Regulations differently. In July 2019, KSA amended amongst others article 33 to make it more liberal, and closer to the Treaty. KSA wanted to make it less strict to apply the zero rate. Unfortunately though, in practice many businesses in KSA are still very conservative in applying the zero rate, for fear of making a mistake. The VAT rate hike to 15% now puts additional pressure on this conservative position.

Impact of the change – ‘and’ and ‘or’ make a great difference

Since VAT entered into force in January 2018, Article 31 of the UAE VAT ER has been a recurring topic of discussion.

Confusion still reigns in a number of situations to decide whether or not to apply the zero rate to a supply made to a client situated outside the UAE. One notable example is that the service provider may not always know the exact set-up of the client (e.g. does the client have a branch in the UAE?).

By replacing the word ‘or’ with ‘and’ in Article 31 of the UAE VAT ER, the UAE narrowed down the possibilities of considering a customer as being outside the UAE for VAT purposes. This move indicates that the legislator expects more situations where businesses restrict the application of the zero rate on their transactions.

For example, under the new rules, possibly a UAE established and VAT registered service provider will have to refrain from zero rating a supply of services to a foreign client who attends one single meeting in the country, which is connected to the services received.

Vacationing in the UAE is allowed up to 30 days, but the slightest business air that the stay gets, or over staying one day, will make the service provider consider the client as established in the UAE.

The foreign client will then get caught in a situation where it might have to evaluate the extra 5% cost on top of the agreed price for the service.

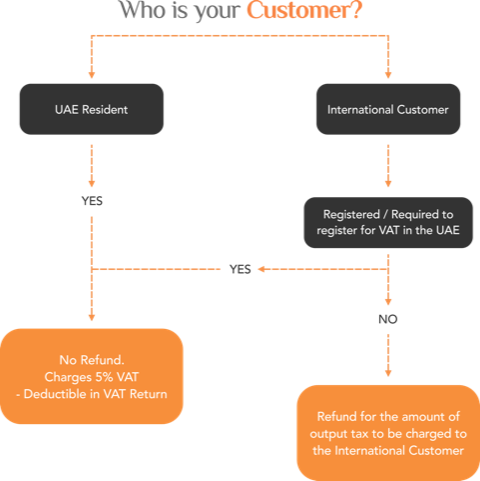

Even though the UAE has implemented a business refund scheme for non-resident businesses similar to the business VAT refund scheme available in the European Union, the requests take a long time to process, and the approval is not guaranteed.

Additionally, foreign businesses will only be entitled to claim a VAT refund in case they are from a country that has VAT and also provides refunds of VAT to UAE entities in similar circumstances (the so-called reciprocity condition). The refund request is available only for countries that are specified in a list published by the FTA.

This one-word amendment might therefore have far reaching consequences. Service providers who are already cautious to apply the zero rate will stay on the side of caution even more. In a number of cases, i.e. cases where no refund is available to the foreign business, it will simply make doing business 5% more expensive.

The UAE Ministry of Finance denied wanting to increase the VAT rate in the UAE, as KSA did recently when it hiked its standard rate up to 15%. One can imagine the additional cost if it did. The UAE therefore adds itself to a list of countries which favor tax revenue. Adding taxes to ‘exported services’ makes domestic service providers less attractive.

Furthermore, it is also not clear if this change to Article 31(2) intends to prevent the zero rate on supplies made to foreign customers who have a fixed establishment in the UAE (e.g., branch or representative office).

Formally prove your client is outside the State

Perhaps I draw too much from the legislation of the old continent, but it remains the system with the longest experience. In the EU, it suffices that your customer has a foreign VAT number to consider him outside of the state of the service supplier. If the customer is outside the EU, the supplier can use a certificate issued by the client’s tax authority, a VAT number or similar, or any other proof to determine the customer is taxable (Article 18 Council Implementing Regulation No 282/2011 of 15 March 2011).

The UAE’s legislation does not have such criteria, and the tax authority has not stated much in this respect. The supplier is left to his own discretion and will try to collect proof of the establishment of his client abroad. However, there’s only so much one can do. Rechecking the client’s status every time an invoice is issued, may increase the burden on a supplier considerably.

Proving that the conditions for exporting a service are met, is up to the supplier. If the FTA wants to audit these conditions, we may end up in a situation where a supplier needs to give an impossible negative proof, e.g. prove to me that the client did not come to the UAE. How does one do that, other than having the client declare that he did not come. Auditing this point will prove very tricky.

Are you inside the State for the export of services but inside the State for input tax recovery?

The change created ambiguity because the same expression is also defined under Article 52 (2) of the UAE VAT ER. However, this Article was not amended by Cabinet Decision No 46 of 2020.

Article 52 of the UAE VAT ER provides rules for the input VAT recovery in respect of exempt supplies and should be read in conjunction with article 54 (1) (c) of the UAE VAT law, which provides that input tax is recoverable if incurred in respect to supplies that are made outside the State which would have been treated as exempt had they been made within the UAE.

According to Article 52 (2) of the UAE VAT ER, “a Person is outside the State even if they are present in the State, provided it is only a short-term presence in the State of less than a month, or that his presence is not effectively connected with the supply.”

The interpretation of this stand-alone extract could lead one to think that the legislator intended to give businesses a stricter approach to zero-rate a supply while providing a broader understanding when granting input tax credit.

It is not likely that the legislator wanted this, but the truth is that once Cabinet Decision No 46 of 2020 enters into effect, the UAE VAT legislation will have two different understandings of the term “outside the state.”

Small word big change

The small change made to the UAE VAT ER via Cabinet Decision No 46 of 2020, is expected to have a significant impact on resident and non-resident businesses operating in the country.

It added an additional layer of administrative burden on UAE suppliers who now have to prove to the tax authority that their customers are outside the UAE as per the new definition of Article 31 (2) of the UAE VAT ER.

Service providers in the UAE, including consultancy firms and law firms who provide services to non-residents businesses must carefully review their transactions and put in place additional administrative mechanisms to ensure that the zero rate is applied only where the conditions of Article 31 are entirely fulfilled.

Foreign businesses who source services in the UAE must also be aware of the new rules and the risk of incurring 5% extra costs on the services received in case they are not considered as being outside the State at the moment the service is provided.

These businesses need to assess the impact of these amendments on their operations and take the necessary actions to be fully compliant with the new VAT requirements.