Just how spectacular are the new UAE Economic Substance Regulations for the UAE?

At a glance

On 30 April 2019, the United Arab Emirates (“UAE”) issued Cabinet Decision No. 31 concerning economic substance requirements (“Economic Substance Regulations”). UAE onshore and free zone entities that carry on specific activities mentioned in the regulations will need to examine whether they meet the economic substance requirements. Failing to meet those will trigger penalties. But why is this at first glance inane looking piece of legislation so important for the UAE?

Background

The introduction of a legal framework regulating the economic substance criterion in the UAE is a direct consequence of the Organisation for Economic Co-operation and Development’s (“OECD”) ongoing efforts to combat harmful tax practices under Action 5 of the Base Erosion and Profit Shifting (“BEPS”) project.

It also follows the increased focus by the European Union (EU) Code of Conduct Group (“COCG”) on companies established in jurisdictions with a low or no income tax regime, resulting in the publication of the first EU list of non-cooperative jurisdictions, which currently includes the UAE (“EU Blacklist”). In response to the EU COCG initiatives, the governments of the Bahamas, Bermuda, British Virgin Islands (BVI), Cayman Islands, Guernsey, Isle of Man, Jersey, Mauritius and Seychelles introduced economic substance rules with effect from 1 January 2019.

There has also been growing interest and scrutiny from the public opinion as to whether entities established in such jurisdictions should be required to have sufficient economic substance before being able to benefit from beneficial tax regimes.

The purpose of the Economic Substance Regulations is to curb international tax planning of certain business activities, which are typically characterised by the fact that they do not require extensive fixed infrastructure in terms of human and technical capital, in a way which allows profits to be shifted to no or nominal tax jurisdictions, as opposed to taxing profits where the company has actually created economic value.

One of the reasons why the UAE has attracted so many businesses is because there is currently no income tax regime at a federal level. The economic substance legislation is specifically targeted at businesses that do not have genuine commercial operations and management in the UAE.

The main reason why the UAE has decided to introduce economic substance legislation lies in the country’s aim to further align its legislative framework with international tax practice and the standards set out in the OECD BEPS action plan.

What is economic substance?

Economic substance is a concept introduced to ensure that companies operating in a low or no corporate tax jurisdiction have a substantial purpose other than tax reduction and have an economic outcome that is aligned with value creation. In other words, economic substance requirements are used to analyze whether a company’s presence has a purpose besides the mere reduction of a tax liability.

Which entities are in scope?

The Economic Substance Regulations apply to UAE onshore and free zone entities that carry out one or more of the following activities:

- Banking

- Insurance

- Fund management

- Lease-finance

- Headquarters

- Shipping

- Holding company

- Intellectual property (IP)

- Distribution and service centre

Entities that are directly or indirectly owned by the UAE government fall outside the scope of the Economic Substance Regulations.

Economic Substance Test

Entities are required to meet the Economic Substance Test when they conduct any of the above activities.

For each Activity, the regulations have defined the so-called Core Income Generating Activities (“CIGA”). This is a list of activities that must be conducted in order to meet the Economic Substance Test. For example, for intellectual property the CIGA would consist of research and development.

In general, the Economic Substance requirements will be met:

- If CIGA are conducted in the UAE;

- If the activities are directed and managed in the UAE;

- If there is an adequate level of qualified full-time employees in the UAE,

- If there is an adequate amount of operating expenditure in the UAE,

- If there are adequate physical assets in the UAE.

In case the CIGA are carried out by another entity, these need to be controlled and monitored.

In accordance with EU recommendations, the regulations provide for less stringent requirements for Holding Company Businesses (“Holding Companies”).

Outsourcing

The CIGA may be outsourced, if there is adequate supervision and the outsourced activity is conducted in the UAE. Economic substance requirements will not be met if multiple Licensees outsource the same activity to the same service provider. There is no possibility for double counting the same service provider.

Reporting and compliance

Licensees will need to prepare and submit an annual report to their Regulatory Authority (Free Zone Authority or DED), within a period of twelve months after the end of each financial year. The Regulatory Authority will then submit the report to the Ministry of Finance (“Competent Authority”).

Since the Economic Substance Regulations came into effect per 30 April 2019, for existing entities, the first report will have to be submitted in 2020.

Administrative penalties and sanctions

– Failure to meet the economic substance test

AED 10,000 to AED 50,000 (First Financial Period)

AED 50,000 to AED 300,000 (Consecutive Financial Periods)

– Failure to provide information

AED 10,000 to AED 50,000

In case of continuous non-compliance, Regulatory Authorities may suspend, revoke or deny renewal of an entity’s license.

Exchange of information

If a Licensee fails to meet the Economic Substance Test for a financial year, the Regulatory Authority will inform the Minister of Finance for the financial year in question.

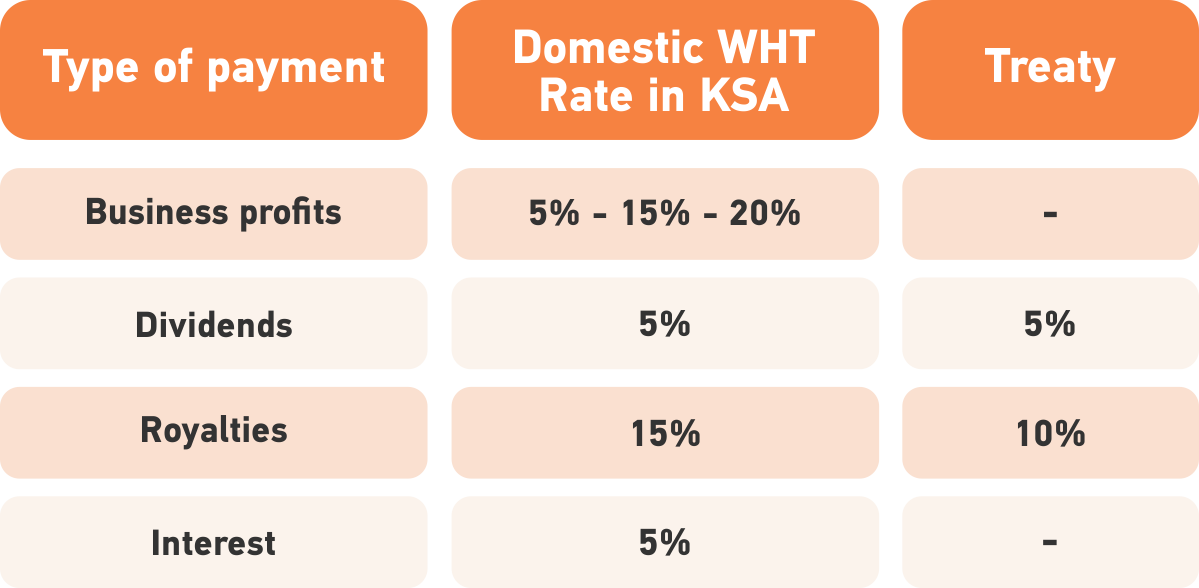

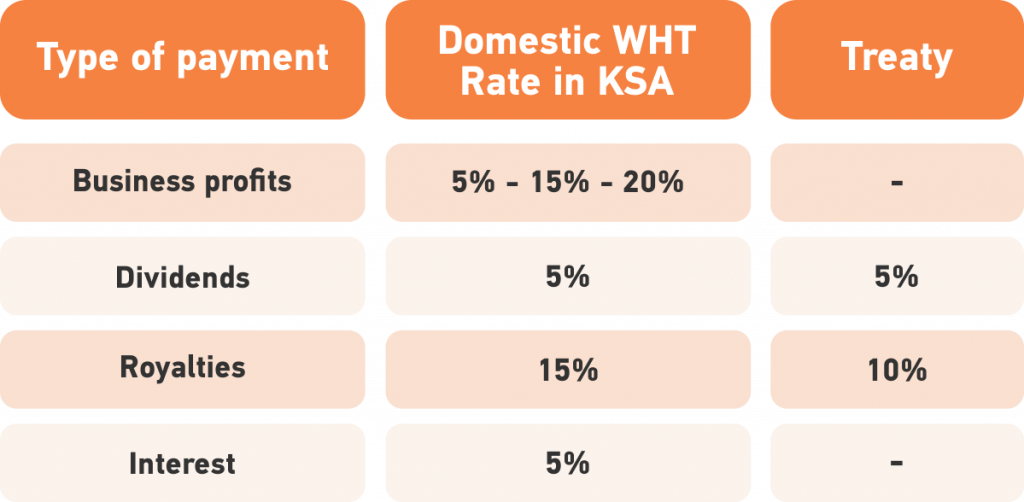

The Minister of Finance will then inform the foreign competent authority where the parent company, ultimate parent company or ultimate beneficial owner is established of the non compliance. This may lead in these countries to denying treaty benefits. This requires that the UAE has entered into a Treaty or similar arrangement with that country.

Takeaway – much ado about?

UAE entities involved in banking, insurance, fund management, investment holding, financing and leasing, distribution and service center, headquarter companies and intellectual property (IP) activities should asses whether their current presence and activity level meets the newly introduced Economic Substance requirements.

Where required, they make the necessary adjustments to ensure that their business is compliant with the UAE regulations which entered into force on 30 April 2019, in order to avoid administrative penalties, and potentially deregistration.

Moving away from the dusty provisions of the law, what consequences does the Economic Substance law now really trigger?

Operational companies should be little worried. They will not be impacted. The very small companies should be slightly worried. The businesses that were attracted by 50 year tax holidays and other promises and failed to develop any substantial activity in the UAE should be more worried.

How much the UAE will be effectively policing this legislation remains to be seen. Merely taking the example of Switzerland, that country had signed up to multiple exchange of information obligations but dragged its feet for the longest time.

For now though, the UAE has an argument towards the EU and, more importantly, individual countries, to get the UAE off their blacklists. This is important, since some UAE headquarters are currently being denied double tax treaty benefits in a number of countries, because of its failure to comply with international norms.

The legislation may potentially become obsolete though, if the UAE introduces Corporate Income Tax at a rate considered high enough to no longer be considered as a low tax jurisdiction.

Read our previous article on the introduction of Economic Substance Requirements in the UAE here.