The New CIT Cabinet And Ministerial Decisions: Insights On The Free Zone Corporate Tax Regime

In January 2022, the UAE announced a new federal Corporate Tax (CT) applicable to business profits for financial years starting on or after 1 June 2023. This marked a significant shift in the UAE’s tax landscape, particularly impacting businesses operating within the nation’s Free Zone Regime.

The UAE Free Zone CT Regime provides a system of economic zones established in the UAE that offer favourable conditions for doing business in and outside the UAE. It provides various benefits, including 100% foreign ownership, certain tax incentives (such as a 0% CT rate), and simplified administrative procedures.

The Federal Decree-Law No. 47 of 2022, known as the “CT Law,” published on 9 December 2022, left some key elements undefined, notably the criteria for a Free Zone (FZ) Person to qualify as a Qualifying Free Zone Person (QFZP), a status enabling access to the FZ’s embedded 0% CT rate. Of the five conditions, two were critical for achieving QFZP status: the requirement to derive “Qualifying Income” and the requirement to maintain “adequate substance”. Yet, definitions of both these terms under the UAE CT law were ambiguous, awaiting further clarification by the UAE Ministry of Finance (MoF).

To address these critical aspects, the UAE MoF issued two landmark decisions on 1 June 2023: Cabinet Decision No. 55 of 2023 on Determining Qualifying Income and Ministerial Decision No. 139 of 2023 regarding Qualifying Activities and Excluded Activities. These decisions – effective immediately upon publication – provide essential guidance for businesses operating in one of the more than 40 multidisciplinary UAE’s FZ. We discuss those elements in further detail below.

1. Determining Qualifying Income for Free Zone (FZ) Persons

The cornerstone of Cabinet Decision No. 55 of 2023 is the definition of “Qualifying Income”. This term encompasses two key areas – transactions with FZ Persons and transactions with non-FZ Persons.

To fully grasp the nuances of this Cabinet Decision, it is essential to comprehend certain key terms. The term “Beneficial Recipient”, for instance, typically denotes the individual or entity that is the actual recipient of the income and has the power to utilize and enjoy the benefits accruing from it (reminiscent of the requirement for passive income under double tax treaties to be the beneficial owner). On the other hand, the term “Good” in the context of this Cabinet Decision refers, amongst others, to any tangible product or commodity that is involved in transactions within any of the UAE FZs.

Also it is crucial to understand what constitutes “Qualifying Income” for entities operating within the UAE’s Free Zones, as it directly impacts their tax obligations under the new UAE CT law.

Qualifying Income by a QFZP includes the following:

– Income derived from transactions with other FZ Persons, except for income derived from Excluded Activities

– Income derived from transactions with a Non-FZ Person, only in respect of Qualifying Activities and not Excluded Activities

– Any other income provided that the QFZP satisfies the so-called “De Minimis Requirements”

Transactions with FZ Persons are relatively straightforward, encompassing all income that a QFZP derives from activities and transactions carried out within the jurisdiction of a QFZP with another FZ Person.

In the context of the new UAE CT Law, Qualifying Income refers to the types of income that are subject to the 0% CT rate. Determining which income is a “Qualifying Income” involves carefully reviewing the types of income, amounts, parties, and transactions involved, as detailed in the charts below.

From the above flowchart, the starting point is analyzing the source of income earned by a QFZP, which can arise from the following 4 categories:

1. Income from Non-FZ Person

2.Income from FZ Person

3.Income from Real Estate

– Immovable Property located in a UAE FZ

– Immovable Property Located in UAE Mainland

4. Income from Permanent Establishment

– UAE Permanent Establishment

– Non-UAE Permanent Establishment.

This article will provide a breakdown of each category of the above flowchart and guide you through the flow to determine whether the source of income will ultimately be subject to 9% or 0%.

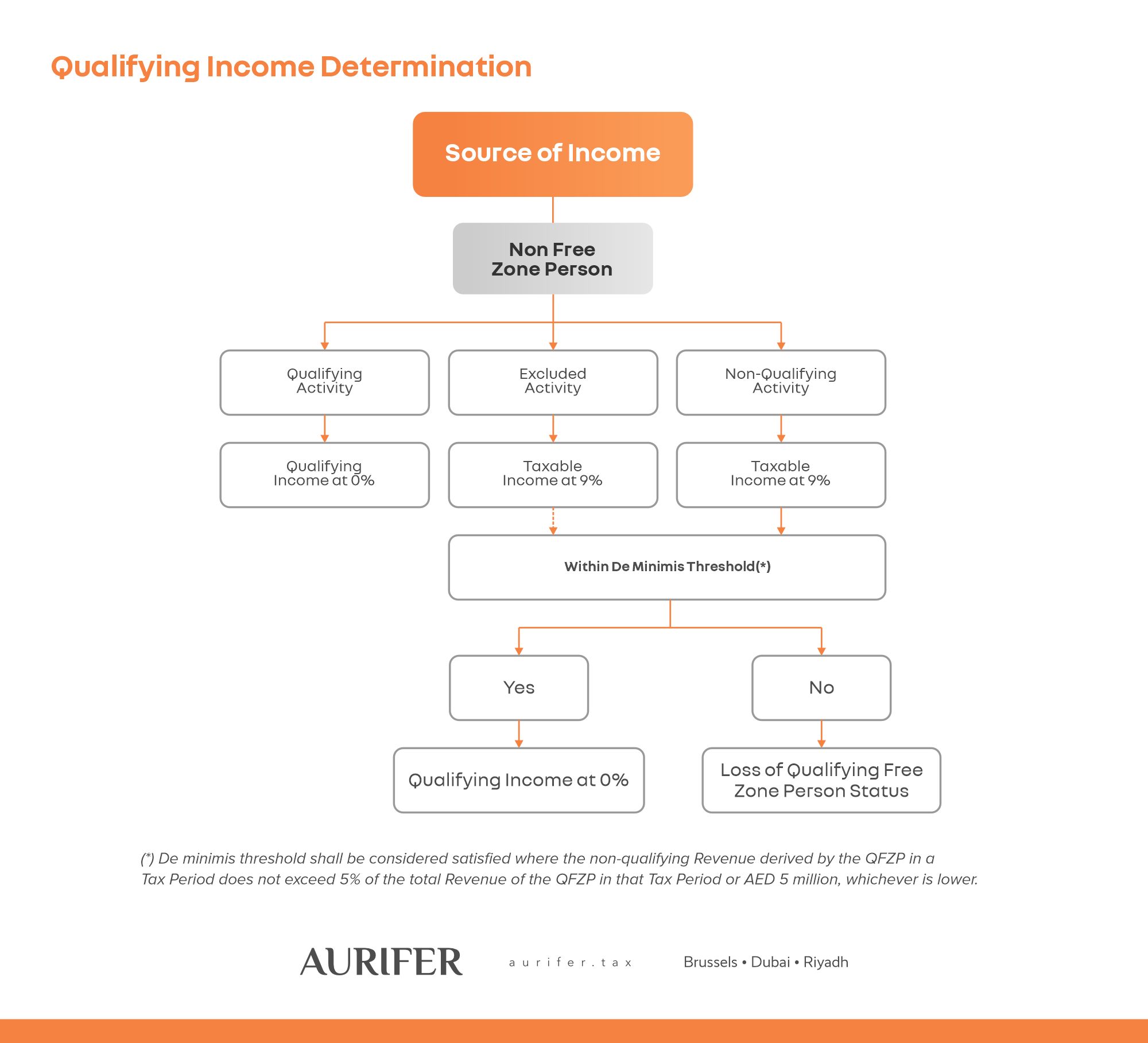

- Non-FZ Person

Transactions with Non-FZ Persons refer to income generated from dealings with entities not registered or incorporated within a UAE FZ. The specific conditions and considerations for such transactions need to be thoroughly evaluated.

For income earned by a QFZP from a Non-FZ Person, a distinction to be made is between Qualifying Activities, Excluded Activities and Non-Qualifying (or Non-Excluded) Activities, the latter being a term which is not defined.

– If the source of income arises from a Qualifying Activity of an FZ Person, the income will be considered as Qualifying Income and is subject to 0%.

– If the source of income arises from an Excluded Activity of an FZ Person, the income will be considered Taxable Income and is subject to 9%. However, this is subject to the so-called “De Minimis Requirements” rule, which will be explained further below.

– If the source of income arises from a Non-Qualifying Activity of an FZ Person, the income will be considered as “Taxable Income” and is subject to 9%, which is also subject to the conditions outlined in the “De Minimis Requirements” rule.

So, what is Qualifying Activity? As per Ministerial Decision No. 139 of 2023, Qualifying Activities include a wide range of business activities and services provided to entities located outside of a UAE FZ, including:

- Manufacturing of goods or materials;

- Processing of goods or materials;

- Holding of shares and other securities;

- Ownership, management and operation of ships;

- Reinsurance services;

- Fund management services subject to UAE regulatory oversight;

- Wealth and investment management services subject to UAE regulatory oversight;

- Headquarter services to related parties;

- Treasury and financing services to related parties;

- Financing and leasing of aircraft, including engines and rotatable components;

- Distribution in or from a Designated Zone that meets relevant conditions;

- Logistics services;

- Any activities ancillary (qualified as such if it has no independent function but is necessary to perform the main Qualifying Activity) to the above activities.

Excluded Activities, on the other hand, are those that are not considered Qualifying Activities and, therefore, cannot benefit from a 0% tax rate, including:

- Banking activities subject to UAE regulatory oversight;

- Insurance activities subject to UAE regulatory oversight;

- Finance and leasing activities subject to UAE regulatory oversight;

- Ownership and exploitation of immovable property (other than Commercial Property located in an FZ);

- Ownership and exploitation of intellectual property assets;

- Any transactions with a natural person, except certain transactions in relation to Qualifying Activities;

- Any activities ancillary (qualified as such if it has no independent function but is necessary to perform the main Excluded Activity) to the above activities.

Any activity which does not fall under Qualifying Activity and Non-Qualifying Activity is referred to as Non-Qualifying Activity.

If the source of the income is from a Qualifying Activity, it will result in 0% tax on the Qualifying Income derived from the Qualifying Activity. However, if the source of income is from an Excluded Activity or Non-Qualifying Activity (together considered as Non-Qualifying Revenue), the taxable income will be subject to 9%, but it may be possible for the taxable income to be considered Qualifying Income if it fulfils the so-called “De Minimis Requirements” rule.

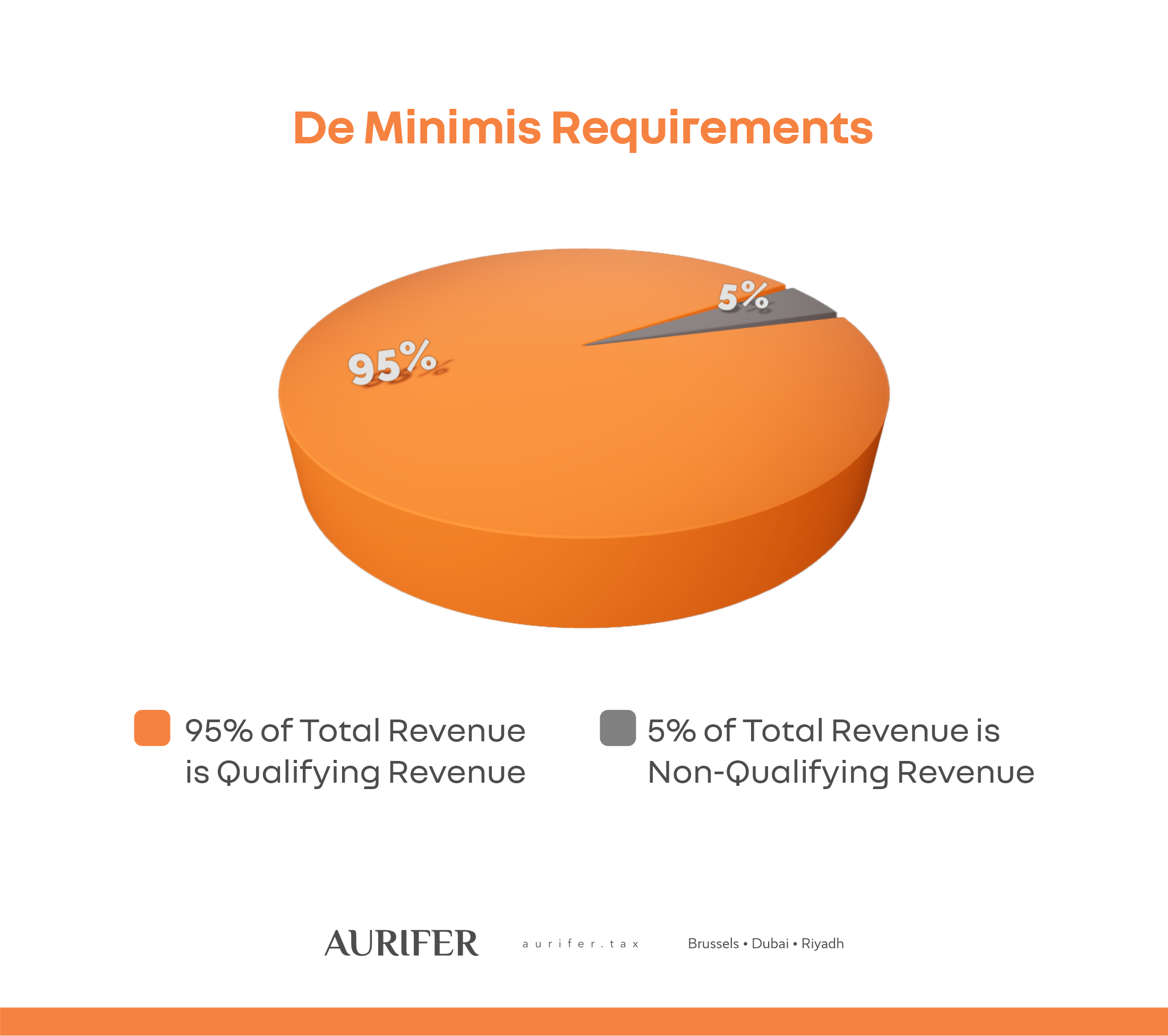

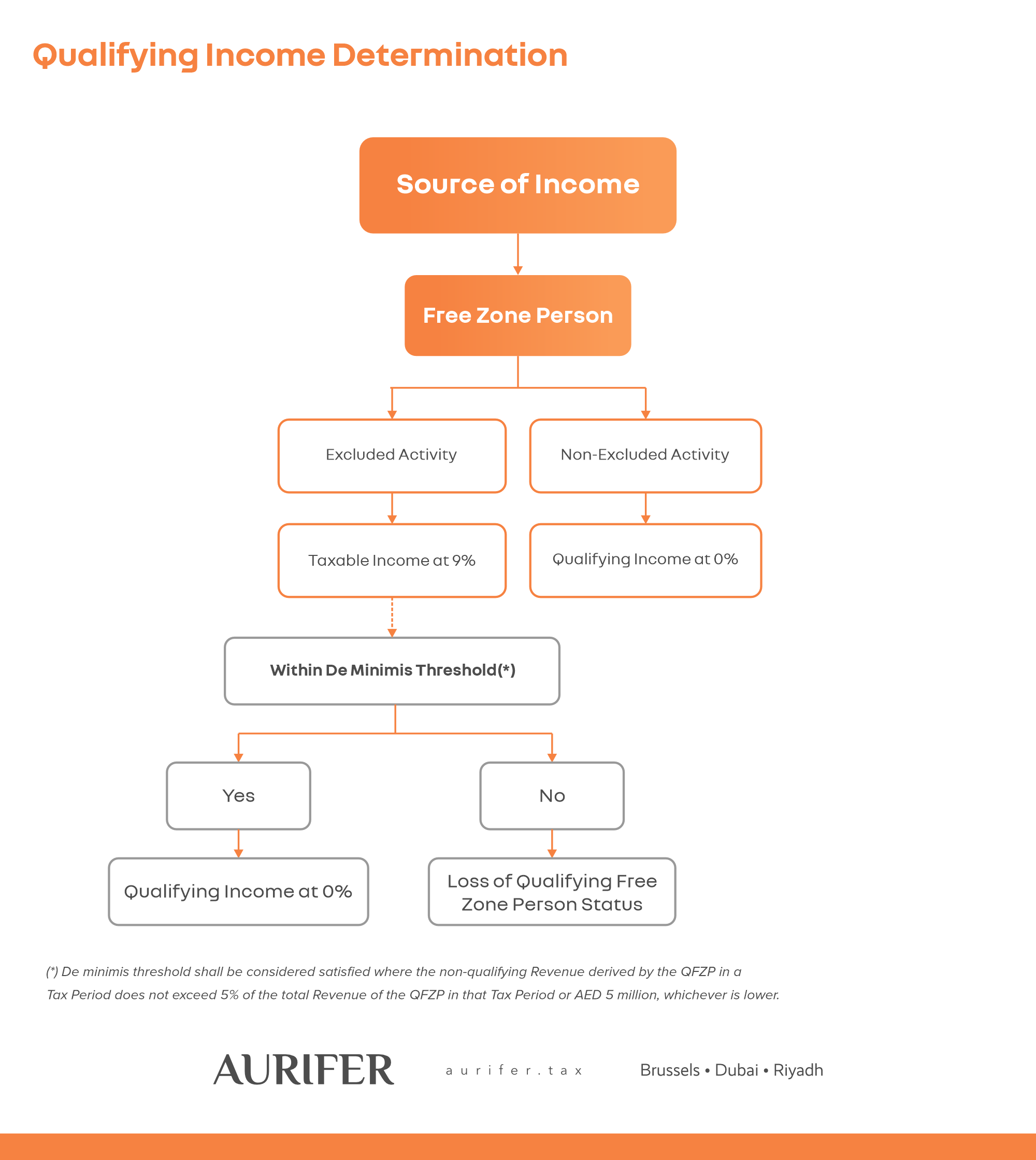

“De Minimis Requirements” are fulfilled where Non-Qualifying Revenue derived by a QFZP are:

- Max 5% of total revenue earned in a tax period by the QFZP;

- Max AED 5 million of revenue earned in a tax period by the QFZP;

whichever is lower.

If the Excluded Activity or Non-Qualifying Activity income level is above the “De Minimis Requirements” threshold, then the FZ Person would not be eligible to be treated as a QFZP, and all of its income would be subject to tax at the standard 9% CT rate in the relevant tax period. Such a business would also be excluded from seeking to be treated as a QFZP for the following four tax periods.

- Free Zone (FZ) Person

For income earned by a QFZP from an FZ Person, the only distinction to be made is between Excluded Activities and Non-Excluded Activities. Excluded Activities are described above.

If the source of income arises from a Non-Excluded Activity of an FZ Person, the income will be considered as “Qualifying Income” and is subject to 0%.

If the source of income arises from an Excluded Activity of an FZ Person, the income will not be considered as Qualifying Income and is subject to 9%.

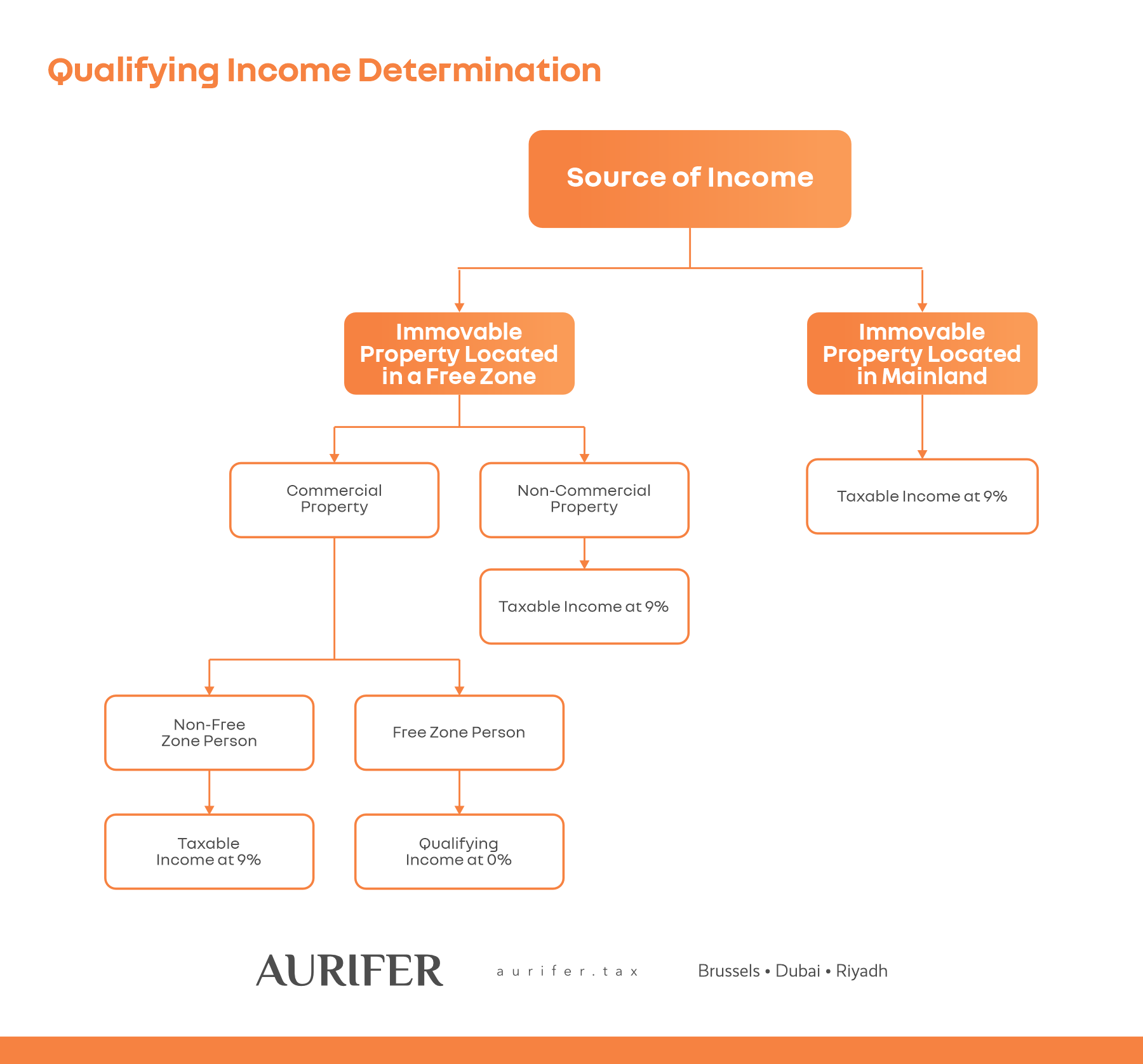

1.3 Income from Real Estate

Cabinet Decision No. 55 of 2023 also provides a special tax regime for income attributable to immovable property located in the Free Zone, which we have shown in the chart below:

1.3.1 Immovable property located in a Free Zone

The source of income for an immovable property can be derived from immovable property located in a UAE Free Zone or Mainland and will have different tax treatments.

If the immovable property is located in a Free Zone, there is a demarcation between a Commercial Property and a Non-Commercial Property.

If the transaction of the Commercial Property is with a Non-FZ Person, the income derived from the transaction will be taxable at 9%.

If the transaction of the Commercial Property is with an FZ Person, the income derived from the transaction will be subject to a 0% tax rate.

On the other hand, any transaction or dealing with Non-Commercial Property by any other person will result in the income being taxed at 9%.

This regime may benefit some of the FZ authorities which are also landlords.

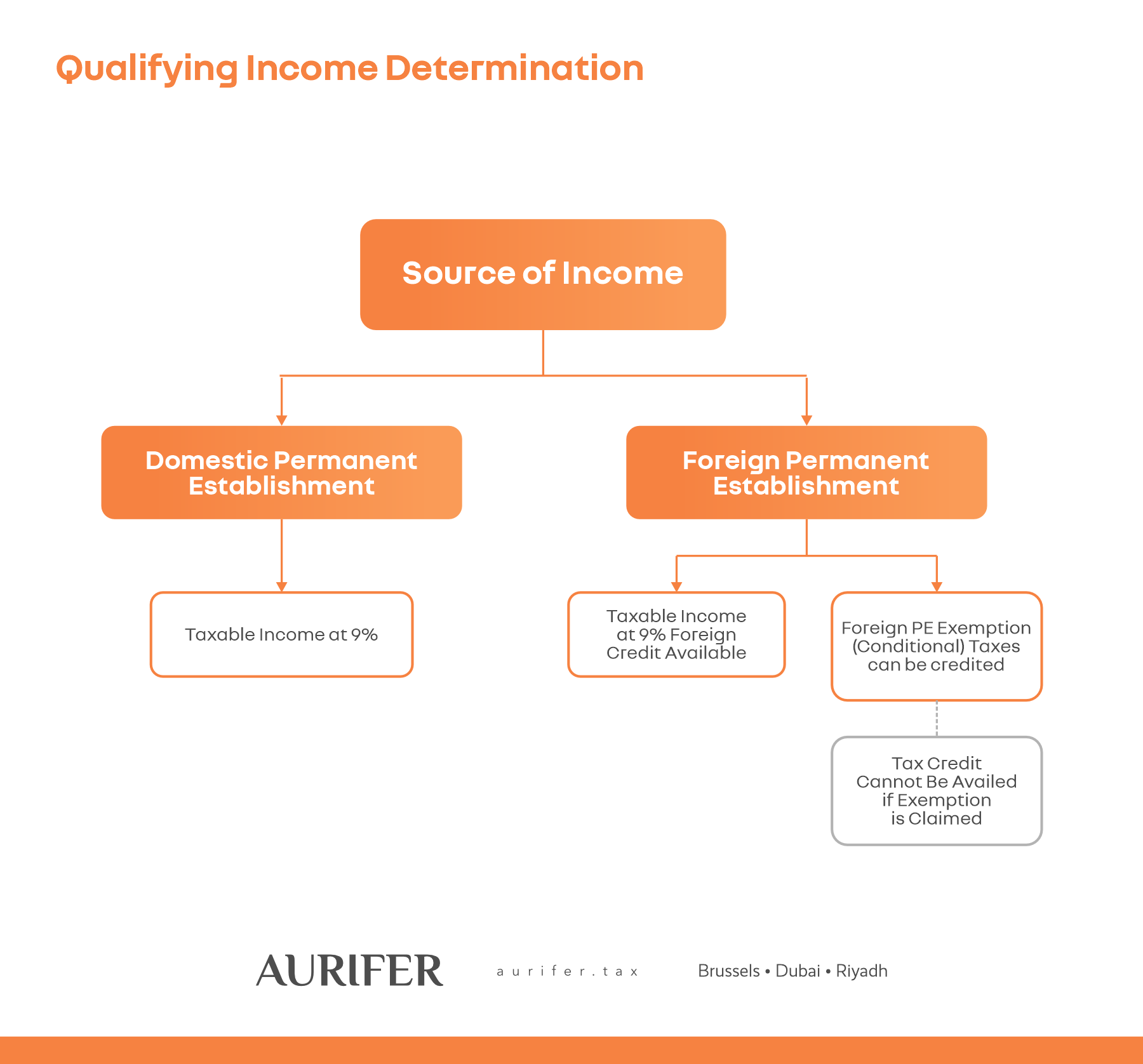

1.4 Income from Permanent Establishments

Decision No. 55 of 2023 also addresses revenue from UAE and non-UAE permanent establishments (PEs). This element plays a vital role in shaping the tax landscape for FZ entities, and a thorough understanding is essential for effective tax planning and compliance in UAE Free Zone Corporate Tax Regime.

A PE refers to a place of business or other form of presence as laid down in Article 14 of UAE CT law through which the business of an FZ Person is wholly or partly conducted. The income generated through a UAE or non-UAE PE should be evaluated under specific conditions.

If the source of income is derived from a UAE PE, the income is taxed at 9%.

If the income is derived from a non-UAE PE, the income is also taxable at 9%. However, foreign tax credit may be available.

It is also possible for an FZ Person to elect for having its non-UAE PE income exempt or disregarded for UAE CIT purposes. In such an event, however, no foreign tax credit will be available.

2. Adequate Substance in Free Zones and Outsourcing

For an FZ Person to qualify as a QFZP, it must derive Qualifying Income and maintain adequate substance. The latter requires the QFZP to undertake core income-generating activities within an FZ. Activities that generate the QFZP’s income must be conducted in a UAE FZ, not just managed from there.

The concept of “adequate substance” ties into the UAE’s Economic Substance Regulations, which aim to ensure that businesses genuinely carry out the substantial activity within the UAE rather than being “shell” or “letterbox” companies. The two legislations operate however independently, and there are subtle differences between them.

A QFZP is allowed to outsource activities to a third party or related party in an FZ, provided it maintains adequate supervision. This means that while the QFZP can outsource some of its activities, it must still have sufficient control and oversight over those outsourced activities. This ensures that the QFZP is still considered to be performing the core income-generating activities within an FZ.

Furthermore, to maintain adequate substance, the QFZP must demonstrate the adequacy of the following commensurate to the activities carried out by the FZ Person:

- Adequate assets;

- An adequate number of qualified employees;

- An adequate amount of operating expenditures.

Contrary to the Economic Substance Regulations, there is no directed and managed criterion for the substance requirements.

3. Practical Examples

3.1 Example 1

FZCo1 is a limited liability company that is incorporated, controlled, and managed in the Dubai International Financial Centre (DIFC), a UAE Free Zone. FZCo1 is a holding company of the FZCo1 Group, which includes many companies conducting different types of businesses in and outside the UAE. The company employs a few persons in its headquarters in DIFC, mainly accounting personnel. The company also has different bank accounts and active credit lines with financial institutions in the DIFC. FZCo1 has established a branch in the UAE mainland and another branch in the UAE’s Free Zone of Abu Dhabi Global Market (ADGM).

Result:

FZCo1 is likely to meet the condition of maintaining adequate substance in the UAE to qualify as a (QFZP). It can therefore benefit from 0% UAE Corporate Tax (CT) on the relevant “Qualifying Income” (i.e., “holding of shares and other securities”). The company conducts its core income-generating activities in a UAE’s FZ (i.e., DIFC). It has adequate assets (i.e., headquarters premises), employees (i.e., accounting personnel), and operating expenditures (i.e., as demonstrated through the bank accounts and active credit lines, and other expenses) therein, considering the nature and level of activities performed. Provided that all the other relevant conditions are met, FZCo1’s branch in the UAE’s Free Zone of Abu Dhabi Global Market (ADGM) can also benefit from 0% UAE CT in respect of income attributable to it. FZCo1’s branch established in the UAE mainland is instead subject to 9% UAE CT in respect of income attributable to it.

3.2 Example 2

FZCo2 is a limited liability company that is incorporated, controlled, and managed in the Jebel Ali Free Zone Authority (JAFZA) of the UAE. FZCo2 conducts multiple activities across different business lines. One of its business activities consists of licensing patents and trademarks of pharmaceutical products to other companies in that industry. FZCo2 also owns several commercial properties in JAFZA, which it leases out to FZ and non-FZ persons to conduct business in that UAE’s FZ. Moreover, FZCo2 owns several commercial properties in the UAE mainland, which are rented to FZ and non-FZ Persons to conduct business therein.

Result:

Even if provided that FZCo2 meets all the relevant conditions to be treated as a QFZP, income from the licensing of patents and trademarks of pharmaceutical products is regarded as income from an “Excluded Activity” (i.e., “ownership or exploitation of intellectual property assets”). Therefore, income from such an Excluded Activity cannot benefit from 0% UAE CT but is subject to the standard 9% UAE CT rate, despite the activity being conducted in a UAE’s FZ (i.e., JAFZA).

As regards income from the lease of immovable property, a distinction must be drawn depending on the type, location and other party involved in the relevant transaction. Only income from the lease of commercial property by FZCo2 in an FZ (i.e., JAFZA), where the other party is also an FZ Person, can benefit from a 0% UAE CT rate. In all other instances, the standard 9% UAE CT rate applies.

4. Other Considerations for a Qualifying Free Zone

Other key considerations associated with qualifying for a FZ person and their implications for businesses are as follows:

- Elective taxation at 9%;

- Elective taxation at 9% effective from the commencement of the tax period in which election is made; (or)

- Commencement tax period following the tax period in which the election was made;

- Cannot be a member of Tax Group;

- Cannot transfer/offset losses to/from taxable (related) persons;

- Participation Exemption applies in relation to income from QFZP (subject to conditions);

- Must file a tax return;

- May be required to file disclosure form along with tax return (to be notified by Authority);

- Must prepare and maintain audited financial statements;

5. Our Take

The newly issued Cabinet Decision No. 55 of 2023 and Ministerial Decision No. 139 of 2023 have provided much-needed clarity to the UAE Corporate Tax framework, particularly for FZ Persons. These decisions have brought forth specific definitions for Qualifying Income, Qualifying Activities, and Excluded Activities, thereby setting clear parameters for tax obligations for businesses operating within one of the more than 40 multidisciplinary UAE FZs. It is also worth mentioning that the guidelines concerning the so-called De Minimis Requirements for maintaining adequate substance have been detailed.

The scope of the 0% UAE CT rate appears to be narrower than initially anticipated, potentially reducing the UAE’s attractiveness as a tax-friendly business jurisdiction. Moreover, the Qualifying Activities do not seem to encompass all the activities businesses may undertake with third countries, potentially limiting the scope of the 0% rate. Financial services, which are traditionally exempt from tax in many FZ jurisdictions when “exported”, are also included in the list of “Excluded Activities”. This could have substantial implications for the financial sector and potentially discourage financial institutions from operating in UAE FZs.

The rationale behind excluding certain activities from the Qualifying Activities list is unclear and could benefit from further clarification. The original purpose of establishing FZ’s was to facilitate export-related income; however, it is important to note that not all activities conducted with third countries fall under this category. Certain services, such as professional consultancy, legal, tax, administrative, along with software development and leasing of non-aircraft assets, are notably excluded from the scope of Free Zone activities focused on export.

Furthermore, businesses and stakeholders must keep an eye on future developments and changes to these laws and regulations as the UAE government continues refining its corporate tax framework. It will be crucial for businesses to monitor these changes closely to ensure that they remain compliant and can effectively manage their tax obligations in the UAE. It is likely that the Ministry of Finance and the FTA’s position on some of the matters might evolve or be clarified.

If you wish to understand the UAE Corporate Tax on Qualifying Free Zone Persons easily, we have simplified the essential information under this topic through this informative animated video.