Taxation of Non-Fungible Tokens – Musings observations and interrogations.

Taxation of Non-Fungible Tokens – Musings observations and interrogations.

Taxation of Non-Fungible Tokens – Musings observations and interrogations.

Download Aurifer’s reply to the Public Consultation initiated by the UAE Ministry of Finance in regard to the implementation of Corporate Income Tax in the UAE as of June 2023.

Planning and protecting for tax risks identified during the due diligence process through the purchase of a specific insurance product has become increasingly commonplace in the last five years. Indeed, the tax insurance market has grown significantly year-over-year, and it is estimated that over $100 billion of specific tax risk was insured globally in 2021. This, of course, is in addition to those unknown and unquantifiable tax risks that are covered by warranty and indemnity (W&I) policies that are now standard in most transactions and, notably, in private equity, real estate, and infrastructure mergers and acquisitions (M&A).

In the text of the public consultation, published by the UAE Ministry of Finance, it discusses its proposed regime for Free Zone Companies.

While the Corporate Income Tax concepts are thus far fairly straightforward, they are much less so for Free Zones.

Contrary to perhaps more simple exemptions for Free Zone companies in the Philippines or India, the UAE is implementing a fairly complex regime, trying to balance a number of interests.

Free Zones have been one of the success stories of the UAE, but incorporating there comes with limitations too, as e.g. the prohibition to trade with the mainland. In mainland, foreign businesses needed a local sponsor or shareholder.

Download the Frequent Question and Answer about UAE Corporate Taxation

It is expected that VAT law will be announced in Qatar during 2022. Together with the other GCC States, it has signed up to the GCC VAT Framework and has committed to implement the common VAT system through national VAT legislation in the near future.

Kuwait has not yet implemented a domestic VAT or Sales Tax Regime. However, together with the other GCC States, it has signed up to the GCC VAT Framework and therefore has committed to implement this common VAT system through national VAT legislation in the near future.

Together with the other Gulf Cooperation Council (GCC) States, Oman has signed up to the Common VAT Agreement of the States of the GCC (GCC VAT Framework) which commits it to implementing a generally common VAT system by issuing national VAT legislation.

51 years after the inception of the UAE today is the historic day on which the UAE announces the introduction of corporate income tax.

In a historic moment, the Ministry of Finance has announced today that the UAE will introduce a Federal Corporate Income Tax on business profits.

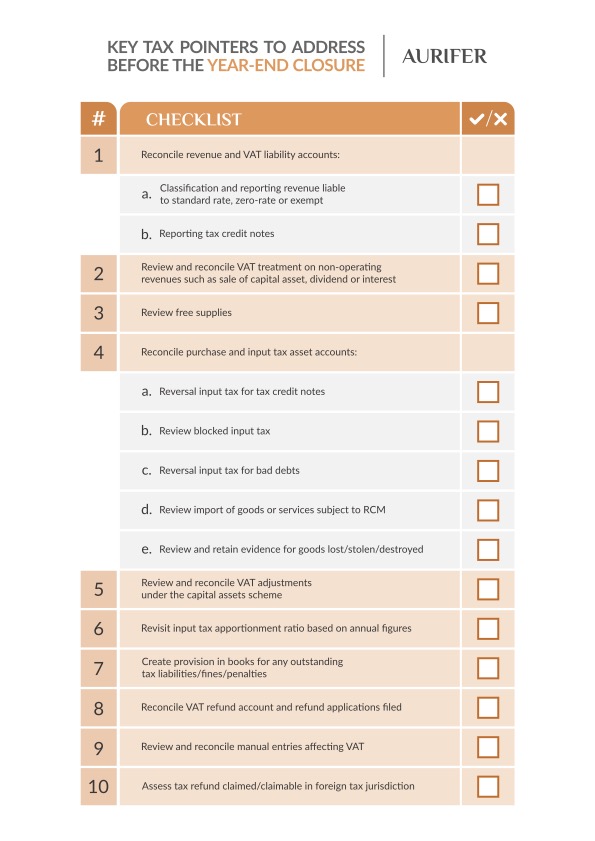

This is Aurifer’s year end checklist with key tax pointers to address before year end closure.

© Aurifer

Developed By Volga Tigris Digital Marketing Agency