Ramadan generosity can be costly for VAT

The Holy Month of Ramadan is the ninth month of the Islamic calendar, observed by Muslims worldwide as a month of fasting, prayer, self-reflection and enhanced community spirit.

The Holy Month of Ramadan is the ninth month of the Islamic calendar, observed by Muslims worldwide as a month of fasting, prayer, self-reflection and enhanced community spirit.

With the impending publication of the drafting of an economic substance law in the UAE, it is important to anticipate the consequences of the introduction of such a law on the UAE and offshore structures in the UAE

In March 2019, the NBR published its fourth VAT Guide, i.e. the VAT Real Estate Guide. This guide aims to provide an overview of the rules and procedures regarding real estate in Bahrain as well as the necessary background and guidance to help taxable persons determine how a supply is treated for VAT purposes

Early 2010’s, following the financial crisis and multiple tax scandals, such as the Panama papers and LuxLeaks, the BEPS initiative was launched by the OECD and the G20. The BEPS initiative is a set of international recommendations meant to prevent Base Erosion and Profit Shifting (international tax avoidance).

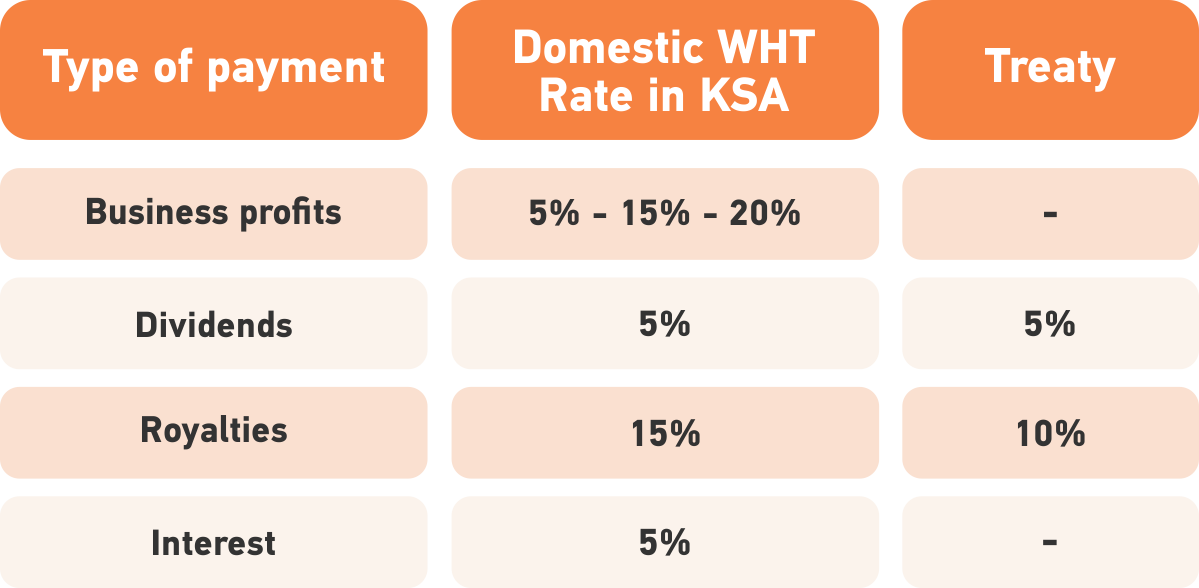

The Double Tax Treaty (“DTT”) between the UAE and the KSA provides a significant tax incentive for businesses operating in the two contracting states.

Since the introduction of its Anti Dumping law in 2017, the UAE has recently imposed anti dumping duties again to tackle goods dumped on the UAE market

Back Share on facebook Share on twitter Share on linkedin Share on whatsapp Share on pinterest Share on email Share on telegram Foreign and domestic

Following the publication of the VAT legislation in Bahrain and the start of a new year, VAT has now become a reality in Bahrain. Bahrain is the third GCC country introducing VAT and the National Bureau of Taxation (“NBT”) will be policing it

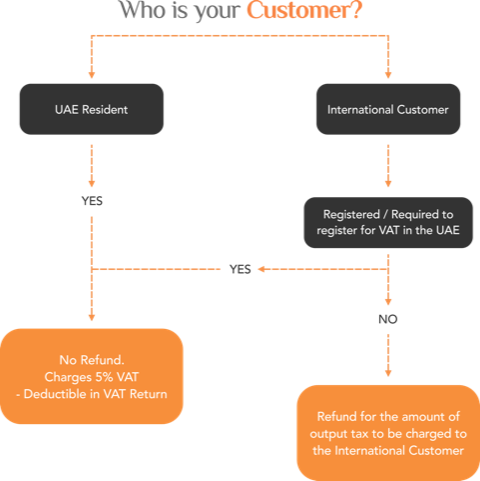

Back With the influx of more than 25 million visitors expected from around 190 countries for Expo 2020, the UAE FTA has implemented two special

The first detailed and comprehensive Transfer Pricing (TP) rules were designed in the 1990’s. The US published regulations in 1994 and the OECD published guidelines in 1995.

© Aurifer

Developed By Volga Tigris Digital Marketing Agency