In the evolving landscape of UAE Corporate Income Taxation (“UAE CIT”), the intricacies surrounding family foundations stand out as an area of significant interest as well as complexity.

Family foundations encounter a unique set of challenges and opportunities under the new UAE CIT regime. The introduction of CIT in the UAE highlighted the importance of not just succession planning but also tax planning and compliance management.

Effective tax planning and compliance, grounded in a deep understanding of the UAE CIT Law (“Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses”), is crucial for these entities to optimize their tax positions, avoid penalties and contribute to their long-term sustainability and growth.

This requires a strategic review of financial structures, operational practices, and investment strategies to align with the UAE CIT framework while achieving business objectives.

This article aims to delve into the nuances of family foundations as outlined in the UAE CIT Law and provide a thorough understanding of their tax treatment.

Family foundations hold a unique position in the UAE legal landscape, with specific provisions of UAE CIT Law applying to them. Understanding these provisions is key to navigating the wealth of tax obligations and benefits you can access using this type of structure.

Under the different UAE laws, multiple types of foundations and trusts exist. A foundation, generally a civil law concept, is, in principle, a type of structure with a legal personality. Being endowed with legal personality, it would be subject to UAE CIT if not for the special regime applicable to it under the UAE CIT Law.

Trusts are generally a common law concept and, in the UAE, also have legal personality when established under the UAE Trust Law (see Article (3) of that Law). The same holds for endowments under the UAE Endowments Law No (5) of 2018 (see Article (10)1 of that law), but not for trusts established in the Financial Free Zones.

Foundations have gained a lot of popularity in recent years. Indeed, in the UAE, these vehicles are mainly used for succession planning and asset protection.

Article 1 of the UAE CIT Law defines a family foundation as a foundation, trust, or similar entity. In other words, the family foundation as a concept under the UAE CIT law refers to a broader context than just foundations per se.

These entities are established with the primary aim of benefiting identifiable natural persons or public benefit entities. The beneficiaries need to be identified or identifiable (e.g., distant relatives, friends, or future offspring). Their core activities consist of managing assets or funds related to savings or investments.

The key provision is Article 17 of UAE CIT Law, which allows family foundations to be treated as unincorporated partnerships and, hence, not be subject to UAE CIT. Following the application of these provisions, family foundations are, therefore, transparent for tax purposes. This means that any potential taxation shifts a level, in this case, to the family foundation’s beneficiaries.

Several conditions need to be met for a family foundation to be treated as a fiscally transparent entity. From an administrative point of view, an application to that effect must be filed with the UAE Federal Tax Authority (“UAE FTA”).

A family foundation seeking to be treated as fiscally transparent is not permitted to undertake activities that would have constituted a business activity within the meaning of the UAE CIT Law if the activity had been undertaken or the assets held by the founder, settlor or any of the beneficiaries of the structure. In this regard, in general, the constitutional documents of the family foundation outline the objectives of the vehicle. Those would normally not include commercial objectives.

This means that if the income was directly earned by natural persons, or the assets directly held by one of the above natural persons, the income would not fall inside the scope of UAE Corporate Income Tax. By reference to Article 11, 6 of the UAE CIT Law, Cabinet Decision No. 49 of 2023 states that employment income, real estate income and personal investment income earned (directly) by a natural person are not within the scope of UAE CIT and do not constitute business income. Real estate income and personal investment income are relevant for family foundations, employment income is not, as a legal person cannot have an employment contract.

The ensuing fiscal transparency also ensures a better alignment of UAE CIT with the neutrality of legal forms. Indeed, the possibility of family foundations being treated as fiscally transparent entities reflects the reality that individuals use those entities to manage their personal wealth and investments for a number of legitimate aims, such as asset protection, succession, and other reasons. The income from those assets would otherwise also not be liable under UAE CIT had it been earned directly by those individuals. The foundation, or the trust, comes with the added benefit of asset protection and succession planning.

Any potential capital gains realized by the family foundation, e.g. through the sale of shares or real estate assets, would also likely not be considered taxable at the family foundation level. This point is, however, unclear, and no guidance exists to confirm it. Equally, in regard to the accumulation of assets, guidance is lacking, but it is assumed by the authors it also benefits from the transparency regime.

Another requirement is that the family foundation must not be set up for the main or principal purpose of avoiding UAE CIT. Given the tax neutrality achieved by a family foundation under the UAE CIT Law, the structure is treated as a pass-through, so there would not necessarily be any possibility for the avoidance of taxes.

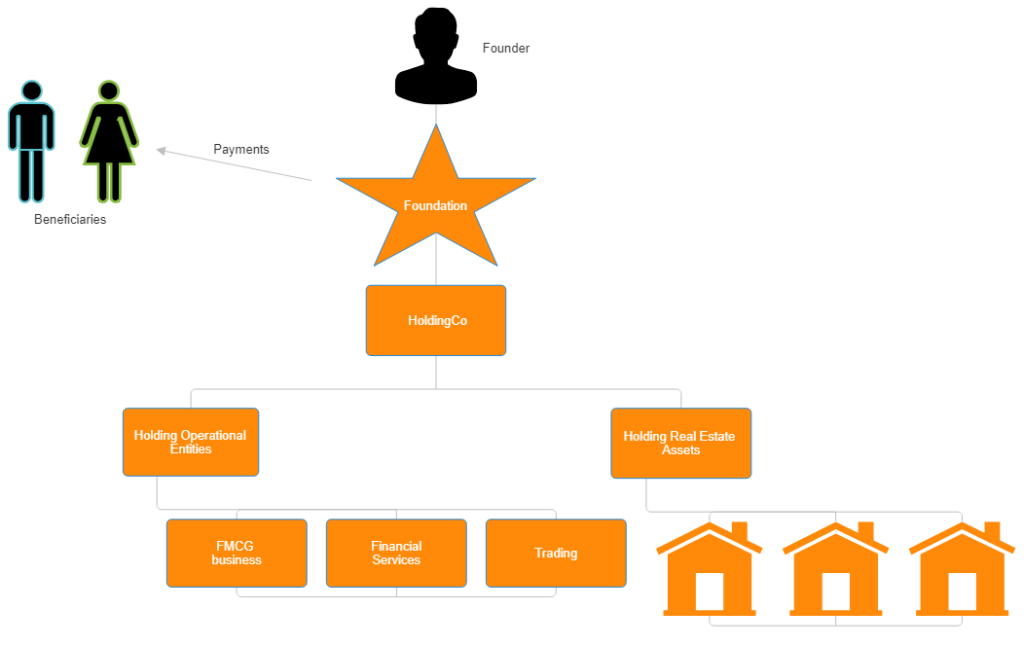

A UAE resident individual wishes to preserve their assets for succession planning and contributes his Dubai real estate assets to the family foundation, as well as the shares held in the top holding company of a large, diversified group. The individual has fallen out with certain kids. He instead wants to favor other kids in terms of succession while avoiding inheritance disputes. Therefore, the individual contributes the shares held in the Holding Co and settles a concessionary rate to the Dubai Land Department for the transfer of the real estate assets into the Foundation. This situation is depicted below.

While not explicitly stated in the UAE legislation, payments made to beneficiaries fall under the general rules. Given that the family foundation is fiscally transparent, the tax regime needs to be analyzed at the beneficiaries’ level.

While not made explicit, we would expect that given the income earned is outside of the scope of UAE CIT, based on the exclusion under the abovementioned Cabinet Decision No. 49 of 2023, there would be no UAE CIT applicable.

If the beneficiaries are not UAE tax residents, however, the tax regime applicable to the payments made to the beneficiaries will depend on the tax regime applicable in the country where the beneficiaries are tax residents.

Disqualified family foundations, because they conduct commercial activities, would not benefit from tax transparency for family foundations. Foundations are legal entities and therefore when disqualified they would be taxed as normal legal persons. As to trusts, this would depend on their legal status, as they may not have legal personality.

VAT and UAE CIT operate under different definitions. Therefore, it is perfectly foreseeable for a family foundation to have no corporate tax liabilities but encounter VAT liabilities.

For example, if it owns rented commercial real estate and its turnover exceeds the Mandatory Registration Threshold of AED 375,000, the family foundation is required to register for VAT purposes.

Under the UAE’s Economic Substance Regulations (“ESR”), licensees earning relevant income are subject to substance requirements, which may entail the obligation for these entities to file a notification and report.

According to the UAE MoF’s FAQs, however, a “trust” or a “foundation” would generally not be considered a licensee. Some foundations may, however, be considered a “Holding Company Business” given that they hold shares and earn passive income. As such, they are subject to substance requirements, which may be limited, as substance requirements for holding companies are reduced.

According to the UAE MoF, the ESR regime may soon be changed or repealed.

In this regard, MOF FAQ No. 107 states: “Further information on the transition from the existing Economic Substance Regulations after the UAE Corporate Tax regime comes into effect and any substance related reporting and compliance obligations for Qualifying Free Zone Persons will be provided in due course.”

Complications arise when assets are held internationally, i.e., if a UAE family foundation keeps assets outside of the UAE territory.

When it comes to real estate assets abroad, they are traditionally agreed to be taxable in the country of situs or source, i.e., where the real estate asset is located. If the income from the real estate is taxable in the country of source, and there is a provision to avoid double taxation under UAE CIT Law or the relevant treaty, the taxes would not be creditable at the level of the family foundation, given that the family foundation is not liable to tax. The tax in the country of source would, therefore, constitute an unrelieved business cost. The beneficiaries also should not be in scope and, thus, would not be able to claim foreign tax credits.

The same situation applies to withholding taxes, which may constitute a pure deadweight cost for the family foundation.

Tax treaty entitlement of tax-transparent entities, such as foundations, is also not guaranteed. Only in 2017 was an additional provision added to Article 1 in both the OECD and UN Model (i.e., under Article 1,2) to confirm that tax-transparent entities can claim treaty benefits, subject to various conditions.

© Aurifer

Developed By Volga Tigris Digital Marketing Agency