Financial Services Tax and Regulatory Webinar

Back Register now for our Financial Services Tax and Regulatory Webinar via lovely@aurifer.tax

Back Register now for our Financial Services Tax and Regulatory Webinar via lovely@aurifer.tax

The Government of Dubai launched a virtual working program for overseas employees wishing to relocate to Dubai whilst retaining employment in their respective countries. This program aims to enable individuals to utilize the economical and tax advantages associated with residing in Dubai, despite being employed in their countries.

While seemingly very attractive, unfortunately it is not that easy for these employees to ensure that their salary will be tax free. In addition, every case may be different. Of course the UAE does not impose Personal Income Tax, but that does not mean that the other jurisdiction will let go that easily.

Disclosing the UBO in the UAE

By way of Cabinet Decision No. 58 of 2020, the UAE has implemented a new UBO regime applicable to businesses established in the UAE, except for ADGM and DIFC businesses. The latter are subject to their own regulations. Government owned businesses are also excluded.

Under the new UBO regime, businesses in the UAE are subject to more strict compliance obligations. For some Free Zones, certain requirements were already in place, and therefore the new regime does not change much.

The new UBO regime stems from the Anti Money Laundering legislation in the UAE, more in particular Federal Decree-Law No. 20/2018 and its Implementing Regulation. It is suspected to targets amongst others disclosures of nominee structures.

The new UBO regime requires businesses in the UAE to maintain beneficial ownership and shareholder registers at their registered office, and to submit information from these registers to their regulatory authority (e.g. DED or Free Zone Authority). Any changes in the information previously provided, need to be disclosed as well.

On 12 October 2020, His Majesty Sultan Haitham bin Tarik issued Royal Decree 121/2020 to implement Value-Added Tax (VAT) in Oman. The Decree is expected to be published on the next official Gazette on 18 October 2020. Watch this space for the English translation.

The law will come into force 6 months after the publication, in April 2021. The standard VAT rate will be 5% and will be levied on most goods and services, with exceptions made to some supplies, which will be zero-rated or exempt.

The Omani law is a closer sister to the UAE VAT law and will follow the Bahraini law, applying hefty penalties, including, in some cases, imprisonment (i.e., failure to register for tax).

VAT is being implemented in response to severe financial and economic repercussions COVID-19 outbreak – amplified pre-existing fiscal strains and low oil prices. The IMF estimated generation of new revenue between 1.5 and 3 percent of non-oil GDP, from the introduction of VAT.

Taxpayers will have a little over six months of preparation time before the commencement date of the law.

The Executive Regulations will be published in December. Registration are expected to open in January 2021. Register for our webinar via lovely@aurifer.tax

COVID19 had a profound impact on economies globally. KSA responded to the impact by increasing the VAT rate from 5 to 15% and take a number of economic measures to stimulate the private sector. The KSA tax authority, the General Authority of Zakat and Tax, also took a number of initiatives.

Attend our webinar on the new ESR law in the UAE. Register via lovely@aurifer.tax

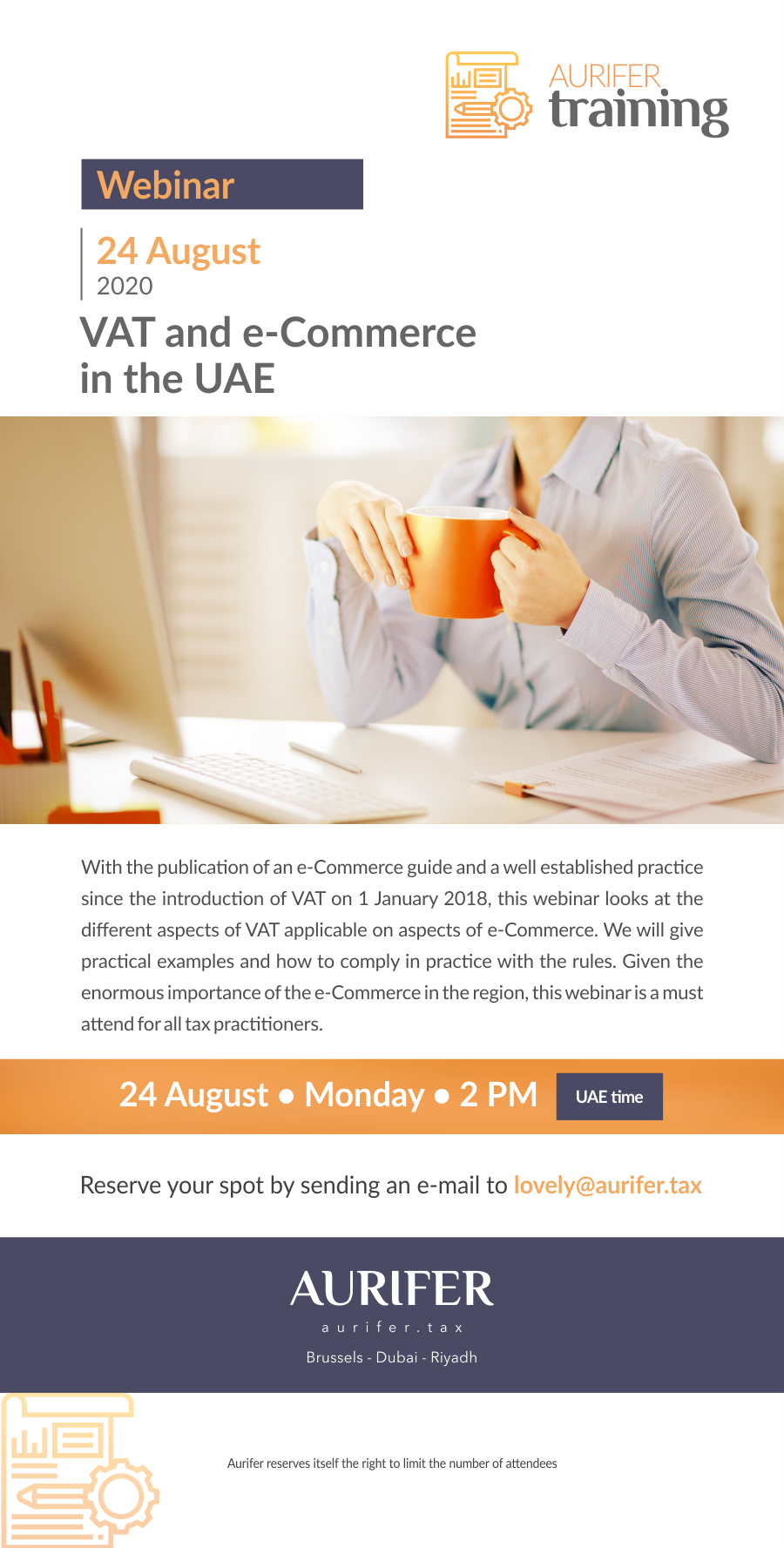

With the publication of an e-Commerce guide and a well established practice since the introduction of VAT on 1 January 2018, this webinar looks at the different aspects of VAT applicable on aspects of e-Commerce. We will give practical examples and show how to comply in practice with the rules. Given the enormous importance of the e-Commerce in the region, this webinar is a must attend for all tax practitioners.

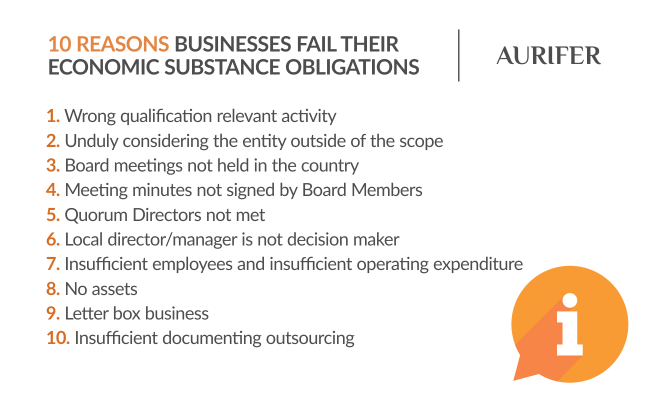

Bahrain and the UAE introduced a legal framework requiring businesses to have substance in their jurisdictions as a direct consequence of the Organisation for Economic Co-operation and Development’s (“OECD”) ongoing efforts to combat harmful tax practices under Action 5 of the Base Erosion and Profit Shifting (“BEPS”) project.

Since a number of years, the European Union publishes a list that focused on jurisdictions which may potentially be harmful to the fiscal interests of the Member States of the European Union (“EU Blacklist”). This blacklist included countries like the Bahamas, Bermuda, the British Virgin Islands (BVI), Cayman Islands, Guernsey, Isle of Man, Jersey and the UAE. In an attempt to see itself removed from the EU Blacklist, the UAE introduced Economic Substance Regulations (“ESR”) with effect from 30 April 2019. In the same year, Bahrain also introduced ESR Requirements with the same purpose.

Register for our webinar on 30 July and know all about the latest developments.

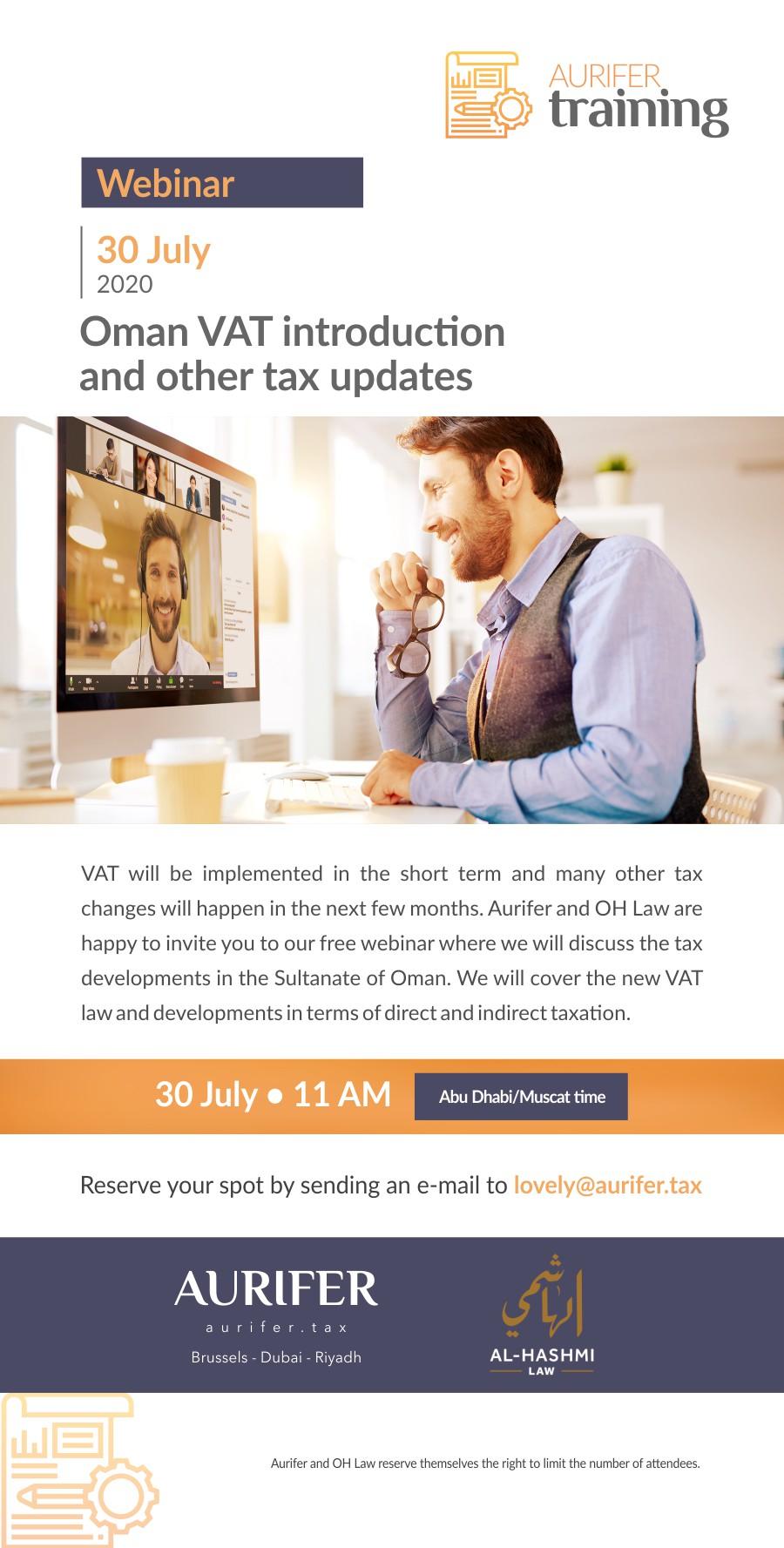

VAT will be implemented in the short term and many other tax changes will happen in the next few months. Aurifer and OH law are happy to invite you to our free webinar where we will discuss the tax developments in the Sultanate of Oman. We will cover the new VAT law and developments in terms of direct and indirect taxation.

Reserve your spot by sending an e-mail to lovely@aurifer.tax. Aurifer and OH Law reserve themselves the right to limit the number of attendees.

#oman #omantax #gcc #gulftax #taxlaw #taxation

The UAE introduced VAT with effect from 1 January 2018. It based its legislation on the GCC VAT Treaty, which is based on the EU VAT directive, and loosely on a few other jurisdictions. The rules were established in 2017. These were untouched until recently.

For the first time in 2.5 years after the introduction of VAT, the United Arab Emirates (‘UAE’) updated its legislation. The UAE’s Federal Tax Authority (‘FTA’) published an updated version of the VAT Executive Regulations (‘ER’) to the VAT Federal Decree-Law.

The updated version incorporates the changes as per a new Cabinet Decision No. 46 of 2020 (Official Gazette issue 680 of 2020 published on 15 June 2020). The updated version amends one article (article 31 (2)) and improves the English translation in a number of places (e.g., article 51 (5) and article 70 (4). It has flagged only the amendment and not the improvements to the translation. According to the UAE constitution, the amendments enter into effect one month after publication.

This article discusses the change, compares it with KSA and the EU, and analyses the practical complexities and formalities.

JBC4 3802, Cluster N, Jumeirah Lakes Towers, Dubai, UAE.

201, 14th floor, Al Sarab Tower, ADGM Square, Abu Dhabi, U.A.E.

Al Anoud Tower L18, Office 1802 King Fahad Road Riyadh Saudi Arabia

Regus Business Centre, Floor No. 2, D Ring Road, Al Mataar, Al Qadeer District, Doha, Qatar

© Aurifer

Developed By Volga Tigris Digital Marketing Agency