Ramadan generosity can be costly for VAT

The Holy Month of Ramadan is the ninth month of the Islamic calendar, observed by Muslims worldwide as a month of fasting, prayer, self-reflection and enhanced community spirit. The annual observance of Ramadan is one of the five pillars of Islam.

Ramadan is regarded as a time of piety, charity and blessings. Charities and foundations are noticeably more active during the Holy Month, providing assistance to those in need. Meals are provided at mosques, malls and other public places in a spirit of generosity.

Businesses see the Holy Month of Ramadan as an opportunity to organize sales and offer promotions, deals, discounts, gifts and benefits of all kinds. For example, companies may offer “buy one, get one free” or “two for the price of one” promotions or combined offers, where certain products are offered for free or at a reduced priced when bought together with another product (e.g. receiving one year of car insurance free of charge when buying a new car).

Traditionally, businesses also celebrate the Holy month by hosting Iftar parties, hand out Iftar snack boxes or give gifts in cash or in kind during Eid al Fitr, the religious feast which marks the end of Ramadan.

This article discuss how to deal with UAE VAT in the spirit of generosity.

There is no such thing as a free lunch?

VAT does not like free items. It taxes so-called deemed supplies, where businesses give things away for free for which it previously deducted input VAT. However, not all free supplies are deemed supplies. Even though both look similar, i.e. a third party seemingly receives something without paying for it, only deemed supplies carry VAT consequences.

As part of its sales strategy, a business may provide a customer with a free item. A supermarket could offer a ‘buy one get one’ formula, for example for shampoo bottles. Although it is providing the second bottle for free, the customer has actually paid a lower price for two bottles. Therefore, this situation is rather a so-called joint offer, and not a deemed supply.

The same reasoning holds for promotional discounts, where a business is slashing its prices with 50% during Ramadan. A business is not offering half of the product for free, but rather a discount on the price.

Perhaps a business considers giving a different item in addition to the item bought. Upon purchase of an electrical toothbrush, the seller offers 2 free tubes of toothpaste. Although the item is given for free, it is still not a deemed supply. The free item is given with the objective of increasing sales of the main item and is ancillary to it.

It is a very different situation when a grocery store decides to donate food supplies to a shelter or to allow all employees to pick an item from its stock for Ramadan. Those constitute deemed supplies and VAT needs to be charged on them. This means that VAT on these deemed supplies constitutes a cost for the business since it is giving the items for free.

If employers upon purchase however already know that they are purchasing items which are not intended for taxable supplies, they cannot recover the input VAT (and the subject of the deemed supplies is not even on the table).

The business making the deemed supplies needs to issue a tax invoice for the deemed supply and ideally deliver it to the recipient. The VAT on the tax invoice is not deductible in the hands of the recipient.

In the UAE, the taxable value of deemed supplies is its cost. This constitutes the taxable basis on which VAT should be accounted for.

However, even though a supply may constitute a deemed supply, two thresholds apply. If a business stays below the thresholds, it can continue to recover the input VAT and does not have to account for VAT on the deemed supply.

There are two thresholds:

- The output tax chargeable on all deemed supplies should not exceed AED 2,000 in a 12 month period (i.e. AED 40,000 of costs VAT exclusive), and;

- The value per person does not exceed AED 500 in a 12 month period (i.e. AED 10,000 of costs VAT exclusive) and it concerns samples or commercial gifts.

These thresholds allow businesses to occasionally provide small benefits or gifts to their employees and third parties without incurring VAT liabilities.

Given the fact that these thresholds are very low, a business will easily exceed the threshold. Taking into account the substantial administrative burden of having to monitor the thresholds and put a process in place, a business could chose to ignore the thresholds and always account for output VAT. That is also what most informed businesses seem to do.

Entertainment and personal expenses made during Ramadan

VAT is only recoverable when it is paid for goods and services bought for making taxable supplies. However, even though a business may exclusively make taxable supplies, there may still be expenses which are non-recoverable.

When an employer buys items and gives them to its employees for no charge and for their personal benefit, the employer cannot recover the input VAT. For example, if the employer decides to purchase chocolate dates for Ramadan to give to its employees, the input VAT paid is irrecoverable.

The same holds for so-called ‘entertainment expenses’. Entertainment services are “hospitality of any kind”. This includes hotel stays, food and drinks, tickets for shows and events and trips for entertainment.

Therefore, if a business organizes an iftar for its employees and for third parties, the input VAT is not deductible. Even though the event is held with the objective of improving social cohesion and increase sales, and therefore it has a clear business purpose, it is considered an entertainment expense.

In a public clarification published by the Federal Tax Authority, it did confirm however that VAT on certain entertainment costs is recoverable when used for a genuine business purpose, or when incidental to a business purpose. For example, VAT on food and drinks provided during a business meeting, is recoverable, if:

- The hospitality is provided at the same venue as the meeting;

- When the meeting is interrupted, it is only by a short break for the provision of the hospitality and then resumes as normal e.g. a lunch break;

- The cost per head of providing the hospitality does not exceed any internal policy the business has established;

- The food and beverage provided is not accompanied by any form of entertainment e.g. a motivational speaker, a live band etc.

On the other hand, where the hospitality provided becomes an end in itself and is the purpose for attending an event, it will be considered as entertainment costs and VAT is not recoverable.

In other words, if the staff comes for the party or for the Ted talk, the business will not be able to recover the input VAT. If the gathering is serious business, the input VAT will be recoverable.

Complex charities

Despite the fact that charities will mostly carry out transactions which are out of scope of VAT, given they do not charge any consideration, they may still occasionally render taxable supplies and therefore incur certain VAT obligations, such as the obligation to register for VAT purposes.

Charities will mostly receive their income from subsidies or donations. Such income is outside of the scope of VAT. Occasionally, it may provide sponsoring opportunities to business, which are subject to VAT.

Under normal VAT recovery rules, input tax is only recoverable where it relates to taxable supplies. In most cases, charities will therefore be required to allocate and apportion VAT recovery between taxable activities (recoverable) and non-taxable activities or exempt activities (non-recoverable). The input VAT recovery may therefore prove to be quite complex.

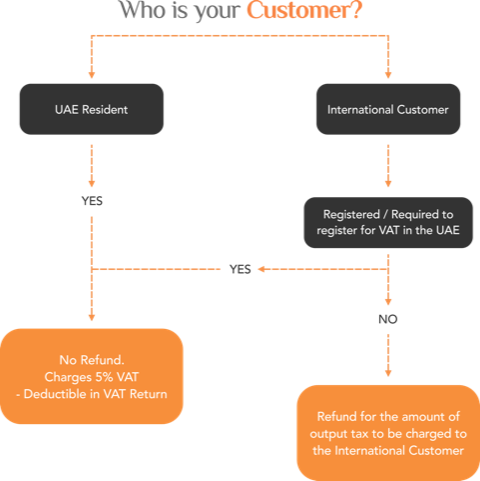

A special refund scheme applies to so-called Designated Charities, which meet the criteria set by the Federal Tax Authority.

Conclusion

The Holy Month of Ramadan triggers VAT consequences for businesses. Businesses making sales promotions are required to examine the VAT consequences of these sales promotions. Business also may need to not recover input VAT on certain purchases or charge VAT on a deemed supply when providing employees with entertainment or gifts. Charities also do not have an easy task ahead in calculating their VAT liabilities.

Given the very strict penalty framework, it is important to be aware of the VAT consequences of these activities in order to avoid VAT claims or penalties.