UAE CIT and Immovable Property

The treatment of income from immovable property under the UAE Corporate Income Tax (UAE CIT) can be complex.

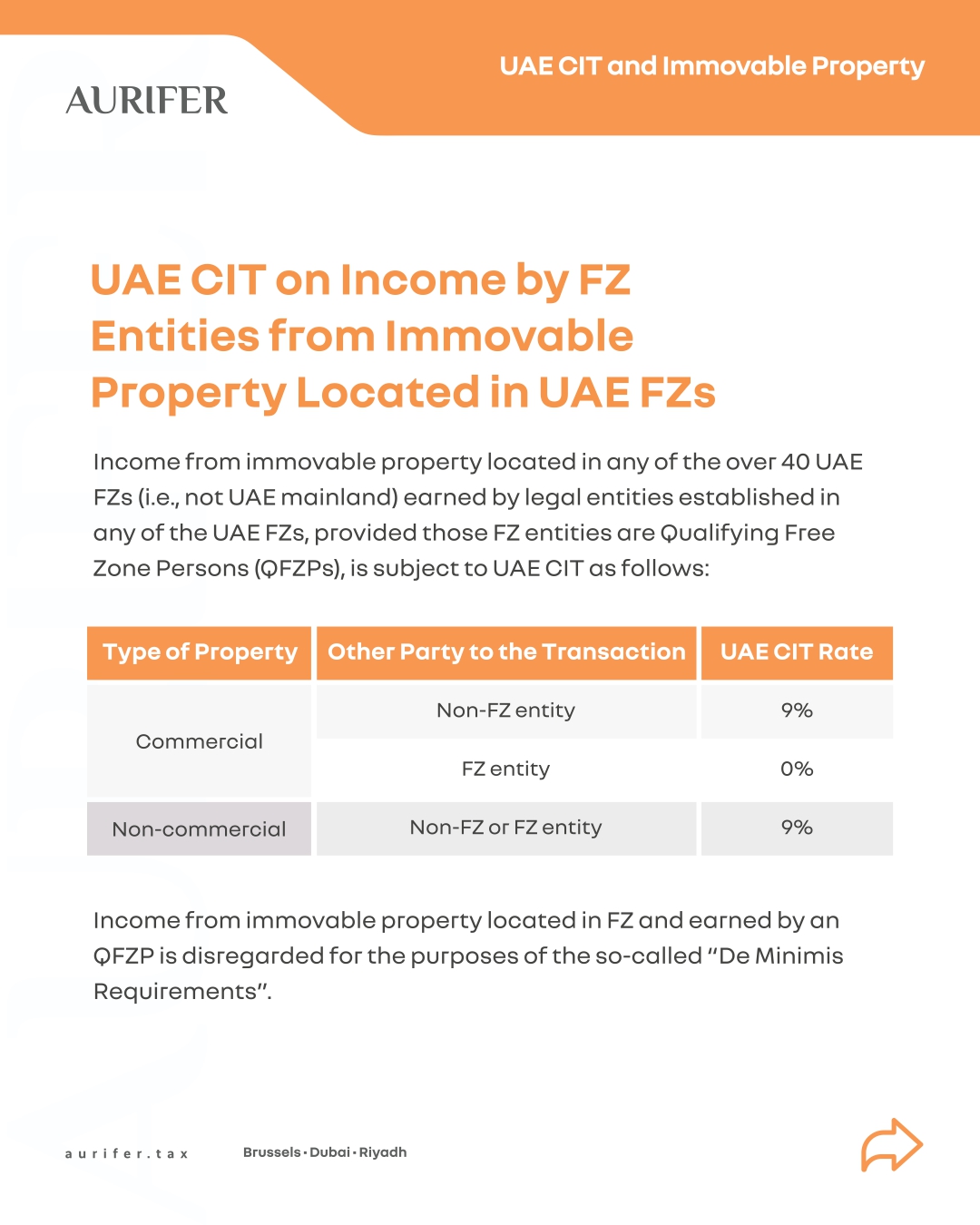

Income from immovable property, whether derived from rent or sale, may be subject to UAE CIT at rates of 9% or 0%, or it might be exempt, depending on various circumstances.

A 9% UAE CIT rate applies to the income that a UAE company earns from real estate located both within the UAE mainland and outside the UAE’s territory. Conversely, a 0% UAE CIT rate is available in certain situations for income from immovable property located in UAE Free Zones (FZs) when earned by FZ entities recognized as Qualifying Free Zone Persons (QFZPs).

Income from real estate situated outside the UAE, when earned by UAE businesses, is taxable in the foreign country. Additionally, as of 1 June 2023, it is also subject to the UAE CIT. However, double tax relief might be available under double tax treaties (DTTs) that the UAE has concluded with other countries, or based on provisions within the UAE CIT law.

Whether you’re a UAE-based or an international business dealing with real estate in the UAE (either in the mainland or FZs) or abroad, this infographic will guide you through the intricate rules surrounding immovable property income under UAE CIT.

Check below to learn more.