Tax Groups under UAE Corporate Income Tax: What You Need to Know

The UAE Corporate Income Tax in Articles 40-42 of the UAE Corporate Income Tax Law (Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses) contains provisions on “Tax Groups”, i.e., the situation where two or more taxable persons are allowed to form a tax group and, therefore, be treated as a single taxable person for UAE CIT purposes.

Forming a tax group may benefit taxable persons from various perspectives, such as the possibility to offset income and losses between its members, tax neutralization of inter-group operations, or administrative advantages such as the ability to file a single tax return.

The UAE Federal Tax Authority (FTA) has further commented on the tax group provisions under UAE CIT in the Corporate Tax (CIT) Guide on Tax Groups (CTGTGR1), issued on 8 January 2024. The FTA’s Guide is a valuable resource for taxable persons who are considering forming or entering into a tax group.

We analyze tax group provisions under UAE CIT, also in light of the latest indications contained in the FTA’s Guide, more in-depth below.

Eligibility Criteria

In order to form a tax group, the parent company must file an application before the FTA, where it needs to demonstrate that all of the following conditions are satisfied:

1. Members of the tax group are juridical persons

For a company to form or be part of a tax group, it must be a juridical person, i.e., an entity with a legal identity separate from its founders, like joint stock or limited liability companies. Accordingly, sole establishments run by individuals do not qualify due to the absence of legal personality. The FTA’s Guide clarifies that unincorporated partnerships, due to their lack of separate legal identity, are ineligible for tax grouping in the UAE, in contrast to incorporated partnerships.

The FTA’s Guide leaves the eligibility of foreign-incorporated partnerships managed in the UAE somewhat open to interpretation. Analyzing the relevant provisions of UAE CIT Law and the FTA’s interpretation of those criteria, it seems plausible that these foreign entities, if managed in the UAE and meeting specific legal entity criteria, might qualify for inclusion in a tax group.

On the other hand, it is settled that a juridical person within a fiscally transparent unincorporated partnership is eligible to join a tax group as a member (see our previous reports discussing UAE legal structures and partnerships here).

There is no limit to the number of members of a tax group. However, a juridical person can only be a member of one tax group at any given time. It is also not possible for a parent company to form or enter into multiple tax groups with different subsidiaries.

2. Members of the tax group are UAE residents

The condition of being resident in the UAE includes both entities incorporated in the UAE and foreign entities if effectively managed within the UAE.

However, residency eligibility extends only to entities recognized as UAE tax residents under applicable Double Taxation Agreements (DTAs). Consequently, a juridical person taxed as a resident in another country under such agreements is outright excluded from tax group membership.

DTAs typically set forth their own criteria determining tax residency and may have tie-breaker rules, or, usually, as a last resource to break the “tie”, MAP to determine in which jurisdiction a company is a resident. Tax residency under the relevant DTA is, therefore, critical for defining a company’s ultimate eligibility for inclusion in a tax group. A foreign company not classified as a UAE resident person is ineligible for tax group membership.

Last but not least, having a permanent establishment (PE) in the UAE does not, by itself, suffice for a foreign legal entity to qualify as a UAE resident since the residence criteria under Article 11(3) of UAE CIT Law are not met by a PE.

Embedded in this requirement is that for the purposes of forming a tax group, a UAE resident parent is required. In other words, a group which a foreign holding company holds cannot qualify (unless the foreign holding company is a tax resident in the UAE).

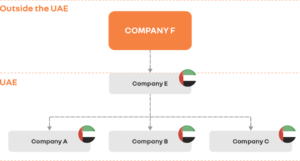

Illustrative example: resident subsidiaries of a foreign parent forming a tax group

Source: Corporate Tax (CIT) Guide on Tax Groups (CTGTGR1), p. 22

Description

Company F (incorporated in and tax resident of a foreign country) holds 100% of the share capital of Company E, which in turn holds 100% of the share capital of Company A, Company B, and Company C. Company A, Company B, Company C and Company E are all incorporated and resident in the UAE for CIT purposes.

Assuming all other conditions to form a tax group are met, Company E, as a parent company, can apply to the FTA together with Company A, Company B, and Company C to form a tax group for UAE CIT purposes.

3. Parent company owns (in)directly at least 95% of the share capital of members of the tax group

Establishing a tax group in the UAE requires the parent company to own, directly or indirectly, at least 95% of the share capital in each subsidiary.

This threshold is key for including companies with minority shareholders, which might be essential due to legal requirements in company formation (e.g. a company type requires two shareholders and the company is incorporated with 99% of the shares held by the parent and 1% by another group company).

Share capital, defined as the nominal issued and paid-up capital, is crucial in determining shareholders’ rights like voting, profit distribution, and capital return.

The FTA’s Guide further elaborates on different types of share or capital and their impact on the formation and maintenance of a tax group according to UAE CIT Law. An important element to note in this regard is that the term “shares or capital” must be interpreted consistently with other provisions under UAE CIT Law and UAE Ministry of Finance (MoF)’s Implementing Decisions (in particular, Ministerial Decision No. 116 of 2023 on the Participation Exemption for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses).

This would suggest an approach favouring a holistic interpretation of the UAE CIT provisions, opening up to cross-references to fill in possible legislative gaps under UAE CIT Law and implementing regulations.

Illustrative example: shares with a different nominal value

Company A (incorporated in and tax resident of the UAE) has issued two classes of shares to its shareholders:

Source: Corporate Tax (CIT) Guide on Tax Groups (CTGTGR1), p. 26

Description

Company B holds 100% of Class 1 shares of Company A. Applying the formula above to Class 1 shares leads to the following result: 1,000 ÷ 2,000 × 100% = 50%.

As the number of shares held in Company A is weighted by reference to their nominal value, the share capital ownership condition is not met by Company B even though Company B has 100% of the Class 1 shares and 99% of the total number of shares.

As rights relating to the shares (such as voting rights and profit rights) are usually determined by reference to the nominal value, this provides a more realistic picture of the ownership stake in Company A.

4. Parent company owns (in)directly at least 95% of the voting rights of members of the tax group

To establish a tax group, the parent company needs to control a minimum of 95% of the voting rights in each subsidiary, counting both direct and indirect holdings. This voting rights condition is separate from share capital ownership and focuses on shareholder-approved matters.

While typically aligned with share capital, voting rights might differ due to share classes, restrictions or unique share types. Accordingly, the assessment of such a condition can produce different results than the share capital condition if restrictions on voting rights apply or if voting rights are not aligned with share capital ownership.

This occurs in the case of shares without voting rights or, on the contrary, carrying extraordinary voting rights. On the other hand, we note that eligibility under the voting rights condition is unaffected in case of vote agreements existing between shareholders or arrangements for a proxy vote.

5. Parent company is (in)directly entitled to at least 95% of each subsidiary’s profits and net assets

Establishing a tax group necessitates the parent company’s entitlement to at least 95% of a subsidiary’s profits and net assets, independently verified from share capital ownership.

This dual condition involves complex assessments, especially when diverse share classes or contractual arrangements exist that might skew the alignment between ownership percentages and economic entitlements.

To this end, the focus is on effective entitlement to profits and net assets. As such, the analysis of both conditions requires a nuanced understanding of legal and financial structures within the company, ensuring that even in the presence of varied share classes, shareholder agreements, nominee agreements or other types of agreements, the parent company maintains the requisite level of control over profits and net assets.

6. No member is an exempt person or QFZP

Tax grouping under UAE CIT specifies that exempt persons or Qualifying Free Zone Persons (QFZPs) are prevented from forming or joining a tax group.

This aligns with the principle of grouping entities having aligned tax obligations (see our previous reports discussing the UAE Free Zone Regime here). In other words, the UAE legislator metaphorically does not want to mix apples and oranges. This is common in other jurisdictions too. Doing otherwise, i.e., allowing tax grouping between members subject to a different tax regime would trigger considerable complexity.

However, a Free Zone Person who is not a QFZP can be part of a tax group if all the other conditions for forming or joining a tax group are met. A Free Zone Person may be a disqualified QFZP or may have opted out of the QFZP regime.

Therefore, being a legal entity established in one of the over 40 UAE Free Zones is not preclusive to tax group eligibility. It also follows that if a tax group member becomes an exempt person or non-electing QFZP, it must exit the tax group from the start of that tax period. Worth noting is that government entities, as exempt persons, cannot form or join tax groups, but their taxable subsidiaries can, under specific conditions. Furthermore, small business relief under Article 21 of UAE CIT Law applies to the tax group’s consolidated revenue, thus possibly affecting individual members’ eligibility for this relief.

7. Members of the tax group must have the same financial year

The financial year condition for tax groups in the UAE emphasizes uniformity in tax filing periods among all tax group members, aimed at simplifying tax administration and reducing the complexity of apportioning results.

This requirement implies that all members must align their financial year with the parent company, including newly incorporated entities wishing to join. Each legal entity can do this by making an application before the FTA before joining a tax group.

Moreover, should there be a need to change the financial year for any member, it must be coordinated across the entire tax group to maintain compliance. This underscores the importance of synchronization in financial reporting within tax groups, ensuring streamlined tax processes and adherence to regulatory requirements.

8. Members of the tax group must prepare their financial statements using the same accounting standards

The accounting standards condition for tax grouping in the UAE mandates not only uniformity in financial years but also in financial reporting. In this regard, it is a requirement that all tax group members use the same standards, typically International Financing Report Standards (IFRS) or IFRS for SMEs if revenue is below AED 50 million.

Financial alignment is meant to facilitate the preparation of consolidated financial statements for the entire tax group, which is crucial for determining taxable income.

In cases where individual members use different standards (e.g., AAOIFI accounting standards for Islamic Financial Institutions), they must align their practices before forming or joining a tax group. The emphasis on consistent accounting practices across the group enhances transparency and accuracy in financial reporting for tax purposes.

As the discussion above shows, establishing a tax group in the UAE is a multifaceted process that necessitates adherence to a series of detailed but also open-to-interpretation criteria.

Modifications to Tax Groups

The FTA’s Guide outlines various scenarios that can occur within a tax group, including formation, joining, leaving, changing the parent company, as well as cessation. The timing of these events is also dictated by the UAE CIT Law. We summarize these events relevant to the lifetime of a tax group under UAE CIT Law below.

The first relevant event relates to entering into a tax group. Joining a tax group involves a subsidiary applying with the parent company to the FTA, provided all the relevant conditions are met. The application submission also determines the tax period for joining. For newly incorporated entities, joining is possible from their incorporation date, either as a new subsidiary or a new parent company.

On the opposite side of the spectrum, there is exiting a tax group. Leaving a tax group occurs when a subsidiary either applies with the parent company for departure, no longer meets membership conditions, or ceases to exist due to business transfer. In cases of business transfer, tax implications of asset and liability transfers are considered, with exceptions for business restructuring relief or qualifying group relief.

Changing the parent company for tax group purposes requires an application to the FTA, ensuring the new parent meets all necessary conditions. This change can happen either through meeting the tax group conditions or as a universal legal successor following a merger or transfer.

We note that the compliance implications of all the changes above are significant. Notably, if a subsidiary does not continuously meet tax group conditions, it must file taxes separately and is liable for its own UAE CIT. Importantly, incorrect tax returns due to unrecognized changes in the tax group can lead to administrative penalties for both the departing entity and the remaining members of the tax group. These complexities highlight the importance of accurate and timely management of tax group status changes to avoid compliance issues and financial penalties.

Deregistration and Cessation of a Tax Group

In essence, the formation or inclusion in a tax group does not necessitate the deregistration of its members, and these members are exempted from filing individual tax returns. A taxable person must apply for tax deregistration if they discontinue their business or business activity.

However, in a tax grouping setting, the cessation is evaluated based on the tax group’s overall activity. This means that if an individual member ceases its business, it does not mandate the deregistration of the entire tax group unless the group as a whole ceases its business activities.

When all members of a tax group cease their business activities, the parent company should request the dissolution of the tax group by applying before the FTA. This application should confirm that all outstanding CT liabilities and administrative penalties have been paid and that the tax group has filed all tax returns. Upon approval of this application, the FTA will deregister the Tax group for CIT purposes from the cessation date or another date set by the FTA.

Subsequently, each member of the dissolved tax group must individually apply for tax deregistration. The FTA’s Guide provides further details as regards the conditions for tax deregistration, including the dissolution of the tax group, a change in the parent company, or the cessation of a subsidiary within the tax group.

When a tax group applies for cessation through the parent company, this application also includes a request for the tax group’s deregistration for UAE CIT purposes. This does not necessarily trigger any consequences for VAT purposes, since tax grouping under UAE CIT is distinct from tax grouping under UAE VAT.

On the other hand, the tax group must confirm in this application that all corporate taxes and administrative penalties are cleared and all tax returns are filed for the FTA to proceed with deregistration. If a tax group ends because it no longer meets the necessary conditions, it must inform the FTA within 20 business days. This notification is also considered the same as a deregistration request. The tax group must state whether all taxes, penalties, and returns are addressed for the FTA to process deregistration.

Finally, in cases where a tax group has only two members, and one transfers its business to the other, resulting in its cessation, the tax group ends as of the transfer date. The remaining entity must notify the FTA within 20 business days of the effectuated transfer, and this notice is taken as a deregistration application. Similarly to other deregistration procedures, the tax group must confirm the payment of all taxes and penalties and the filing of returns for the FTA to proceed with deregistration. No separate application for business restructuring relief is needed in this scenario.

Conclusion and grouping as a planning tool

In conclusion, the ultimate decision to form or join a tax group under UAE CIT Law involves a balanced evaluation of envisaged tax advantages and disadvantages. It is crucial for MNEs operating in the UAE to ensure that all relevant factors are properly considered and that the decision on tax grouping aligns with the MNE’s overall strategic objectives.

Notably, tax grouping serves its best purpose when certain members of the group are loss-making entities. This is because, in a tax group setting, the losses of loss-making members of the tax group are offset immediately and in full against the profits of the profit-making members.

On a standalone basis, instead, losses can be carried forward and offset against 75% of future taxable income. On a standalone basis, losses can also be transferred between members of the same qualifying group (not tax group), which would require that members are 75% commonly held. A downside of forming a tax group is that the nil bracket up to AED 375,000 only applies once at the tax group level instead of multiple times at the individual member’s level.

Moreover, where administrative simplification may be touted for a group’s tax filing, it is not necessarily much simpler, given that a consolidation first needs to take place from an accounting and tax point of view. The filing itself (i.e. filing the numbers on the portal) is not in itself a very burdensome exercise.