30 June 2021 – End of transitional period to apply 5% VAT in KSA

Background

In May 2020, the KSA announced an increase in the standard VAT rate from 5% to 15% effective from 1 July 2020. Transitional rules for supplies spanning the date of the VAT rate change (1 July 2020) were introduced. In brief, these transitional rules state that if you entered into a contract prior to 11 May 2020 for supplies to be made after 1 July 2020, the 5% rate would still apply until the end of the contract, the contract renewal date or 30 June 2021 (whichever occurs first), if the customer is entitled to recover the VAT charged by the supplier in full, or if the customer was a government entity.

These transitional rules were optional, and even if the conditions were met, you could choose to apply VAT at 15% from 1 July 2020. B2C supplies were simply immediately subject to 15% VAT, as were imports of goods.

Meanwhile, the other GCC countries which implemented VAT, i.e. the UAE, Bahrain and Oman continue to apply 5% and have no plans currently to increase the VAT rate. The average VAT rate applied in the EU is approximately 21%. KSA therefore still has a relatively reasonable rate.

End of transitional period

Businesses currently applying the transitional regime, will no longer be able to avail it, and need to be mindful to apply 15% VAT for supplies rendered as from 1 July 2021.

You may still be making supplies under a contract entered into prior to 11 May 2020, where this contract has continued and was not subject to renewal, i.e. there was no cessation or renewal of the contract to trigger the end of the application of the 5% rate. In this case, where you are still charging VAT at 5%, this must end on 30 June 2021. For goods or services supplied before 30 June 2021 the 5% rate can still apply, however for all supplies made from 1 July 2021 the VAT rate of 15% must apply.

Action to be taken

Where business are currently still applying 5%, this will need to be increased as of 1 July 2021. The boxes in the VAT return where 5% output or input needs to be reported, may remain for some time. Tax payers may need to issue credit notes for initial supplies subject to 5%, and the recovery of input VAT can be done during a period of 5 years.

For businesses that had been availing the transitional regime, the cash flow impact will be significant. Caution needs to be taken as well as to expense invoices, as invoices with the wrong VAT rate will not be claimable.

Where do we go next

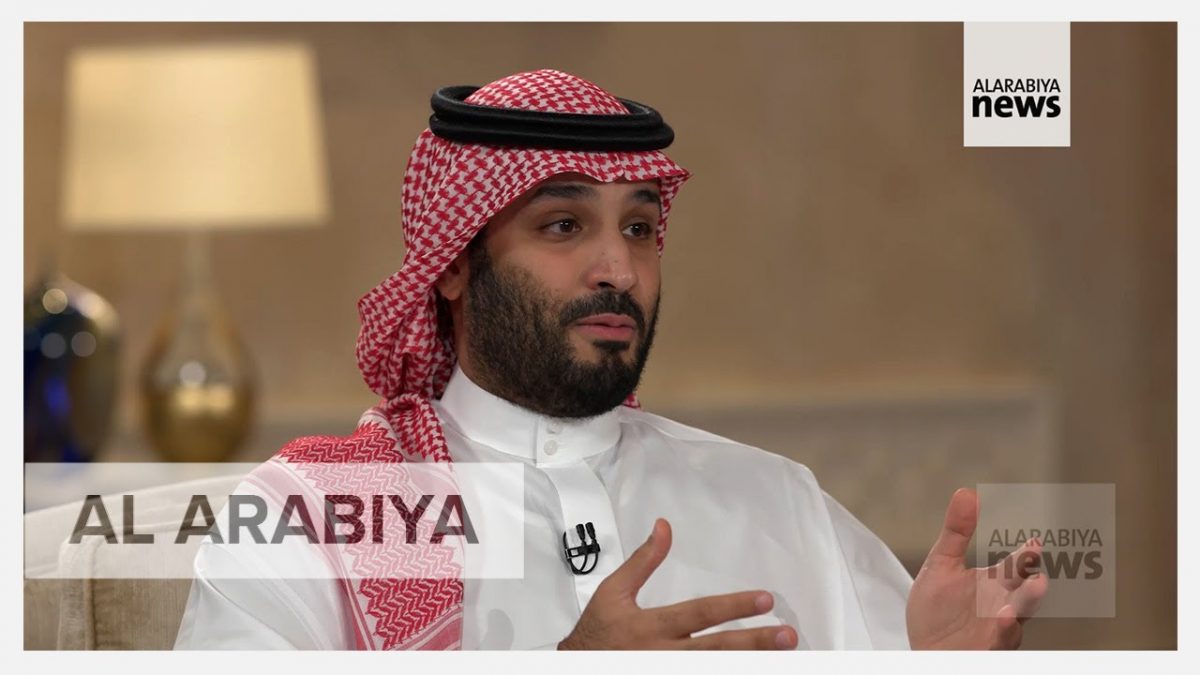

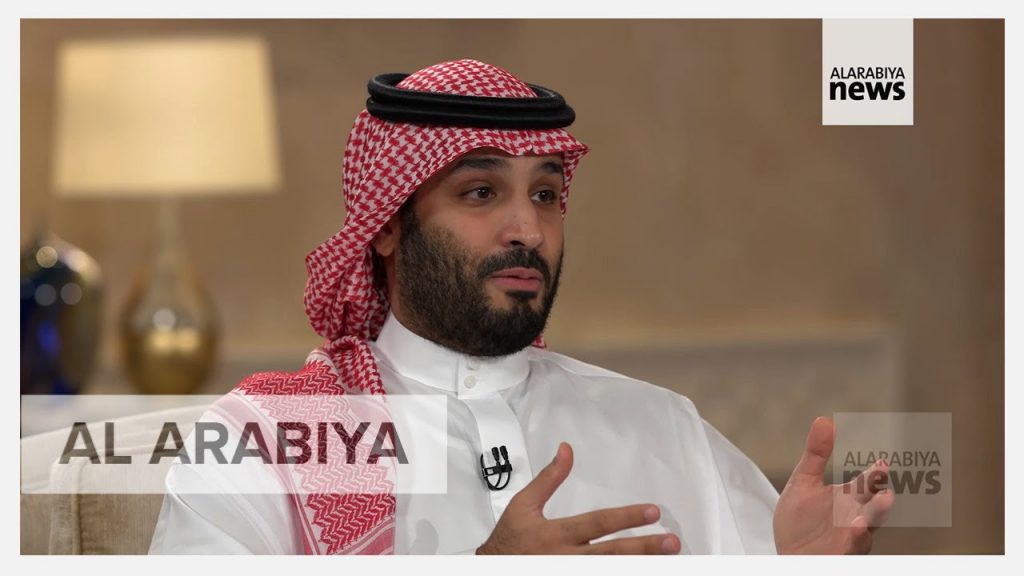

The Crown Prince of KSA, H.E. Mohammed Bin Salman (“MBS”), announced recently that the 15% VAT rate is a temporary measure that may last only for the coming 5 years. Increasing the VAT rate was necessary to help the ambitious government toward realizing its KSA 2030 vision.

MBS stated that the rate will reduce to a rate of 10% or even 5%. Undoubtedly, there will be new transitional provisions then.